The concept of ‘absolute return

Absolute return bond strategies are investment processes that seek to generate positive returns regardless of market conditions, unlike relative return strategies, which seek to outperform a benchmark index.

Although there are various types of strategies, certain common characteristics can be identified:

Objective: To seek to generate a positive return regardless of market fluctuations.

Risk management: Close attention to fund volatility and control of losses.

Flexibility in asset selection: Use of a wide range of financial instruments, including derivatives, long and short positions1

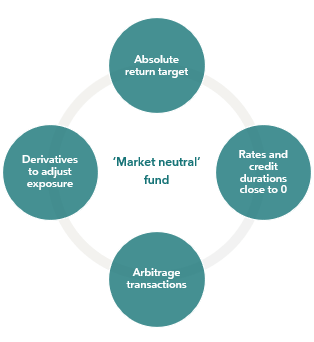

The ‘market-neutral’ approach

A ’market-neutral’ bond fund is one that aims to generate a positive return regardless of the overall performance in the bond market. It seeks to minimize the impact of interest rate and credit movements by implementing hedging strategies.

While a ‘market-neutral’ fund always has an absolute performance objective, the opposite is not necessarily true. An absolute return fund may retain directional exposure to interest rate and credit markets.

1Long position: positively exposed to the performance of an asset. Short position: negatively exposed to the performance of an asset. 2Strategy using long and short positions in the fixed income markets. For more details, see page 2

Main strategies

There are several types of absolute return strategies, to meet the varying needs of investors in terms of return and risk. Some strategies may be market-neutral, while others are not, depending on their construction. However, the most common approaches are as follows:

« GLOBAL MACRO » VIEW

This strategy is based on the analysis of major macroeconomic trends (growth, inflation, monetary policy) in order to adjust the fund's exposure to bonds that seek to offer the highest potential in this environment.

DIRECTIONAL RATES STRATEGIES

A directional rate fund is a bond fund that seeks to profit from changes in interest rates by taking directional positions. Unlike traditional bond funds that seek to replicate an index, these funds actively bet on rising or falling rates to seek to generate yield.

« LONG/SHORT » STRATEGIES

Funds following a long/short strategy expose themselves to bonds they consider undervalued within their investment universe, and sell those whose price seems too high in view of economic fundamentals, notably through derivatives.

«RELATIVE VALUE » APPROACH

A ‘relative value’ fund seeks to identify temporary price differentials between bonds, interest rates or credit instruments. With this in mind, the management team takes ‘long’ and ‘short’ positions to neutralize market risk.

" carry trade " funds

‘Carry trade’ is an investment strategy that involves borrowing in a low-interest currency to invest in a higher-yielding currency. The aim is to take advantage of the interest rate differential to generate regular income.

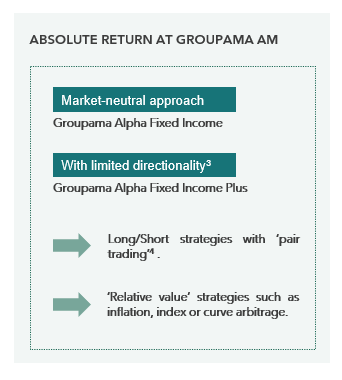

3Groupama Alpha Fixed Income Plus seeks to approach neutrality in the face of market movements, but may retain a limited degree of directionality at the discretion of the management team. 4Peer trading involves buying one asset and selling another similar or correlated asset, with the aim of profiting from the performance gap between the two.

A FAVORABLE ENVIRONMENT for non-directional strategies

With the gradual withdrawal of liquidity injected by central banks, dispersion within bond indices is set to increase.

‘’ THE CURRENT ENVIRONMENT VALIDATES THE MARKET-NEUTRAL APPROACH

This dispersion is reflected in a lower correlation between bond segments. Now, each segment (sovereign, corporate, financial, high yield) reacts differently according to its fundamentals, increasing the dispersion of assets within the same index

At the same time, financial markets are operating in a deteriorating macroeconomic and geopolitical environment, with sources of uncertainty multiplying since the start of the year. We therefore believe that this context should lead to periods of greater volatility.

In this environment, market-neutral strategies ideally meet the needs of investors looking for a more defensive approach, but one that could generate performance gradually and relatively steadily over time, as in our Groupama Alpha Fixed Income and Groupama Alpha Fixed Income Plus funds.

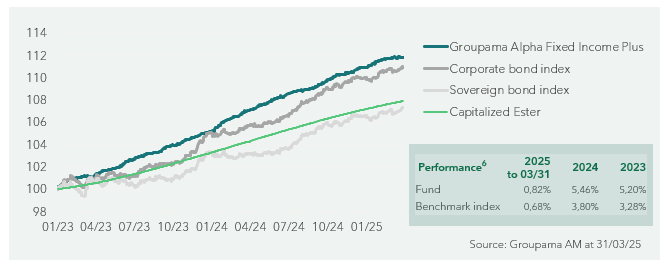

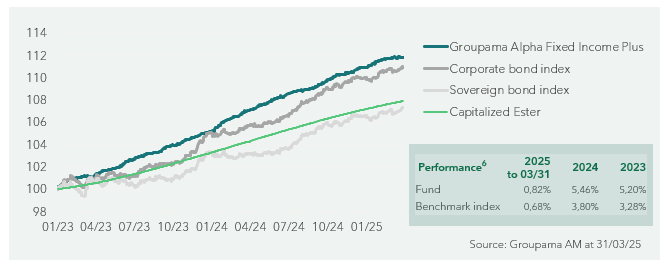

As the chart below illustrates, the current environment validates the market-neutral approach. While directional bond indices have experienced periods of volatility, Groupama Alpha Fixed Income Plus (NC) fund, with its limited directionality, has shown an almost linear progression since the strategy was launched.

Performance of Groupama Alpha Fixed Income Plus (NC) fund and its benchmark since inception, as well as sovereign and corporate bond indices5

Past performance is no guarantee of future performance, and is not constant over time. All investments carry a risk of capital loss.

SRI : 2/7

This indicator represents the risk profile displayed in the DIC. The risk category is not guaranteed and may change during the month.

Recommended investment period: 18 months

MAIN RISKS :

- Risk of capital loss

- Interest rate risk

- Credit risk

- Counterparty risk

- Liquidity risk

- Derivatives investment risk

Please refer to the prospectus for a complete list of risks.

Marketing Communication

Disclaimer

Groupama Asset Management declines all responsibility in the event of alteration, distortion, or falsification of this document. This document is intended solely for its designated recipients. Any unauthorized modification, use, or distribution, in whole or in part, is prohibited. Groupama Asset Management shall not be held responsible for any use of this document by third parties without its prior written consent.

All investments involve a risk of capital loss.

The information contained in this publication is based on sources we consider reliable, but we do not guarantee that it is accurate, complete, valid, or up to date.

This document has been prepared based on projections, estimates, and assumptions that involve a degree of subjective judgment. The analyses and conclusions are the expression of an independent opinion, formed from information available at a given date and according to a methodology specific to Groupama AM. Given the subjective and indicative nature of these analyses, they do not constitute any commitment or guarantee by Groupama AM, nor personalized investment advice.

This non-contractual material in no way constitutes a recommendation, a solicitation of an offer, or an offer to buy, sell, or arbitrate, and should not be interpreted as such.

Groupama Asset Management’s sales teams and its branches are available to provide you with personalized service.

Published by Groupama Asset Management, a management company authorized by the AMF under number GP 93-02 – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com