SUSTAINABLE FINANCE

A COMMITMENT TO SOCIALLY RESPONSIBLE FINANCE

For more than 20 years, Groupama Asset Management has included the dimension of social responsibility into its investment model. The team organization and the fund range is built on a common ESG foundation, comprising:

- Proprietary methodology for ESG analysis,

- Shareholder engagement policy,

- Exclusion policies,

- And the monitoring of sustainability risks.

By taking this proactive approach, Groupama Asset Management enables its customers to direct their investments with absolute confidence towards companies that are contributing to building the world of tomorrow

A CONSTANT AND TRANSPARENT COMMITMENT TO SUSTAINABLE FINANCE

Our ESG approach

SHINING A LIGHT ON INVESTMENT CHOICES

The sustainable investor approach of Groupama AM is based on a comprehensive analysis of companies, covering both financial and ESG aspects. The objective is to understand how companies adapt to major societal changes. To achieve this, we analyze how each company responds to the risks and opportunities presented by these three transitions. The consideration of ESG criteria enables our management teams to better anticipate trend reversals and integrate the risks and opportunities that companies face into their investment decisions.

DEMOGRAPHIC

TRANSITION

It integrates the consequences of societal changes - population ageing, urbanization, rising inequalities - for companies on the management of their human capital and the entire value chain.

ENVIRONMENTAL

TRANSITION

It is the transition from an economy based on fossil fuels to an economy based on low-carbon and on the management of environmental impacts such as the protection of biodiversity from business activities.

Digital

Transition

It represents the impact of new technologies, the ability to manage data at a very large scale, on companies' internal processes, their relationships with their customers, suppliers and civil society

A proprietary ESG analysis methodology that demands strict standards

Groupama AM applies its own internal rating model that meets the requirements of the double materiality principle:

- Financial materiality: this criterion determines the negative impact (risks) or positive impact (opportunities) that ESG factors have on the financial value of the company.

- ESG materiality: this criterion measures the negative impacts of the company’s activities on the environment and society.

To limit and reduce the negative impacts of its investments, Groupama AM monitors and measures sustainability risks via the regular meetings of the Sustainability Risks Committee.

Fossil Fuels Policy

Groupama AM fully supports the fundamental aim of the Paris Agreement - to keep the average global temperature increase during this century well below 2 °C above pre-industrial levels - and recognizes that the continued increase in carbon emissions will cause a rise in global temperature and climate-related extreme events, primarily driven by human activities.

Groupama AM introduced its coal sector exclusion policy back in 2019. Since the beginning of 2023, this policy has been reinforced with new constraints on unconventional fossil fuels.

Controversial Weapons Policy

In 2009, Groupama Asset Management defined a rigorous policy for the exclusion of investments in companies involved in activities relating to controversial weapons. This policy was expanded in March 2024.

Our commitment

SHAREHOLDER ENGAGEMENT AT GROUPAMA AM

Shareholder engagement as a lever for influencing companies to improve their ESG practices and strategies

Tools available to investors for communicating their views to companies:

- regular dialogue with the executive committee or board of directors,

- participation in general assemblies and submission of resolutions to the general assembly,

- public declarations,

- reduction of investments if dialogue is unfruitful.

Key features of Groupama AM’s ’engagement policy incorporated into its investment strategies:

- ESG risks and indicators,

- controversial activities,

- combined financial and ESG analysis, investment decisions,

- engagement, exclusion and impact.

Engagement at Groupama AM means:

3 top-priority engagement themes:

- Sustainability risk

- Environmental and energy transition

- Gender pay gap

Groupama AM also broadens its engagement to collaborative action on national and international initiatives.

ENGAGEMENT POLICY 2024

Chaired by the CEO of Groupama AM, the Shareholder Engagement Committee meets 2 times a year and has two main missions – to validate the company’s engagement and voting policies and to monitor the implementation of these policies via annual reports.

VOTING POLICY 2024

Voting at the general meeting is a key feature of the “governance” pillar of Groupama AM’s ESG policy. The Groupama AM voting policy is reviewed annually to incorporate any changes in laws and regulations, governance codes, market practices and the recommendations of our in-house analysts.

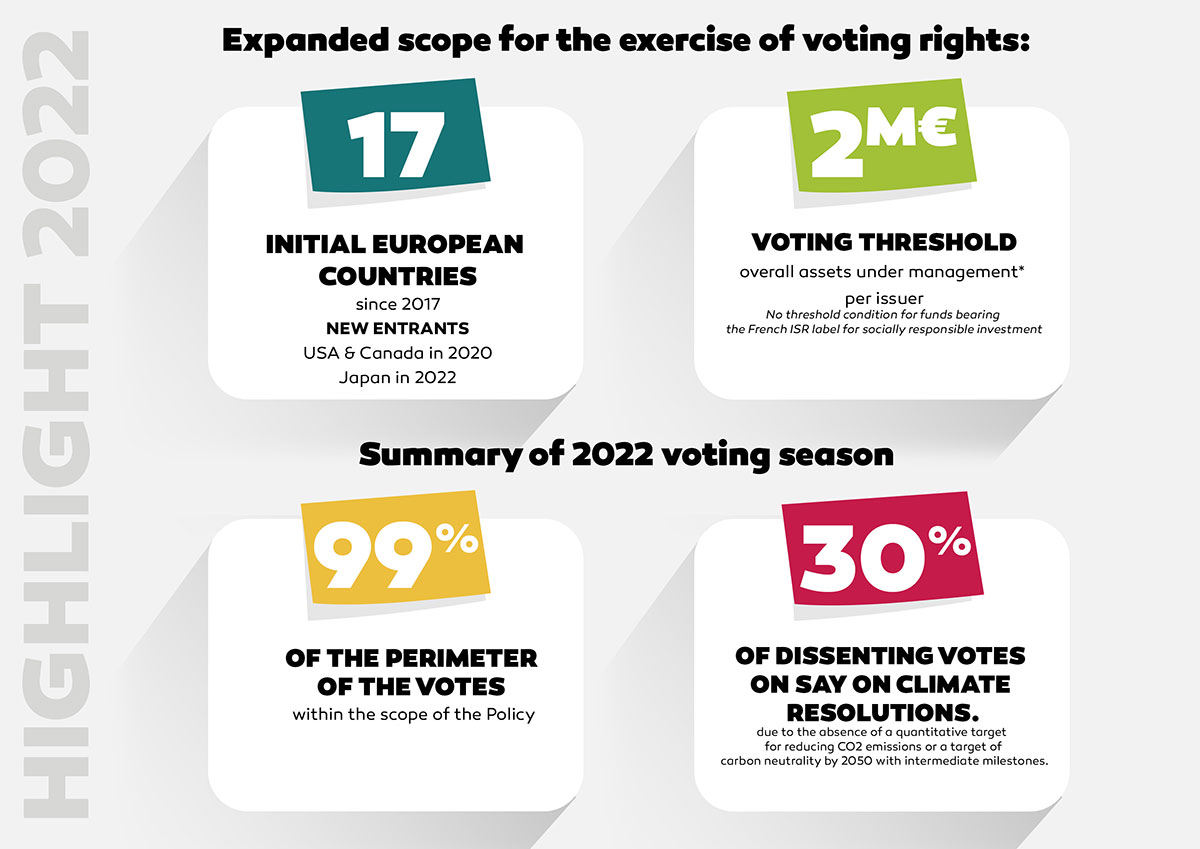

ENGAGEMENT AND VOTING REPORT 2022

Find out more about our Commitment and Vote 2022 report.

UNDERSTAND SUSTAINABLE FINANCE WITH GROUPAMA ASSET MANAGEMENT

A TO Z OF SUSTAINABLE FINANCE

Socially responsible investment is at the core of our corporate culture.

Groupama AM regularly publishes guides, policies and other informative content for all our stakeholders, in particular private and professional investors and our internal partners.

REGULATORY REPORTING

Article 29 of the ENERGY-CLIMATE LAW

Report on voting rights at General Meetings 2022