Marketing communication

Synthesis

Banks' revenues are generally impacted negatively in a low-rate environment, which can put pressure on their net interest margins.

However, banks have implemented strategies to mitigate these adverse effects, including hedging instruments and cost rationalization measures such as sector consolidation and cost-cutting programs.

While a potential continuation of monetary easing by the European Central Bank could negatively affect banks' profitability, these impacts are expected to remain moderate, with an even more limited effect on the stability of subordinated bank debt.

As a result, we remain positive on subordinated financial bonds, which could also attract interest from yield-seeking investors within a bond carry strategy in a declining rate environment.

Concerns over a compression of net interest margins

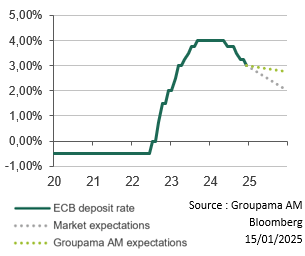

Rate Cut Expectations: Market and Groupama AM

The European Central Bank (ECB) initiated a cycle of rate cuts in the summer of 2024. Since then, it has announced three additional rate cuts, bringing the deposit rate down to 3.00%. We believe the ECB is likely to adopt a more defensive approach in 2025, constrained by stronger-than-expected growth and persistent inflation. However, our central macroeconomic scenario still anticipates one more rate cut.

A rate cut cycle can sometimes result in a flattening of the yield curve, meaning a narrowing of the gap between short- and long-term yields for the same issuer. This phenomenon affects the revenues and net interest margins of banking institutions, leading to a negative impact on their profitability.

This outcome is linked to the operating model of banks, particularly commercial banks. Their business largely relies on maturity transformation—borrowing short-term to lend long-term—which exposes them to the risk of net interest margin compression in the event of a yield curve flattening.

The calculation of this result is based on net interest income, which is the difference between:

- Income from loans and bond investments;

- Expenses related to interest paid to depositors and creditors.

Banks are implementing strategies to mitigate negative impacts

Banks employ several strategies to minimize the effects of low interest rates on their financial results:

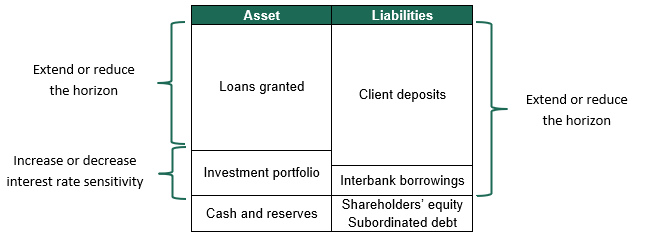

Asset-liability matching: Through this approach, banks aim to balance the potential impact of interest rate movements on their balance sheets. One lever available to banks is their investment bond portfolios, where they can adjust interest rate risk based on market expectations. For instance, by extending the duration of their bond portfolios, banks can lock in a specific yield over a longer period—a strategy that has gained traction in recent quarters to mitigate the risk of a low-rate environment.

Similarly, banks can extend or shorten the horizons of their loan, deposit, and borrowing portfolios to mitigate the effects of rate movements.

Example of a Simplified Balance Sheet for a Commercial Bank

Use of Derivatives: Banks also use derivative products, such as interest rate swaps or options, to hedge against interest rate fluctuations. For example, an interest rate swap allows a bank to exchange a fixed interest payment stream for a variable one, or vice versa, depending on its market forecasts. The use of these instruments enables banks to either increase or decrease the sensitivity of their interest income to rate movements.

Cost Rationalization Through Consolidation: The consolidation of the European banking sector over the past 10 years has, in addition to rationalizing the cost base, also reduced competition for deposits. During the recent rate hike cycle, banks have only partially reflected these increases in the remuneration of demand and term deposits, which offer low returns but are favored for their perceived liquidity and safety. These low-cost deposits stabilize funding despite the compression of interest margins on loans. Moreover, this consolidation fosters rational competition, enabling banks to strategically adjust their pricing policies to preserve margins while avoiding price wars. As a result, the largest institutions gain resilience and profitability, reinforcing the sector’s stability.

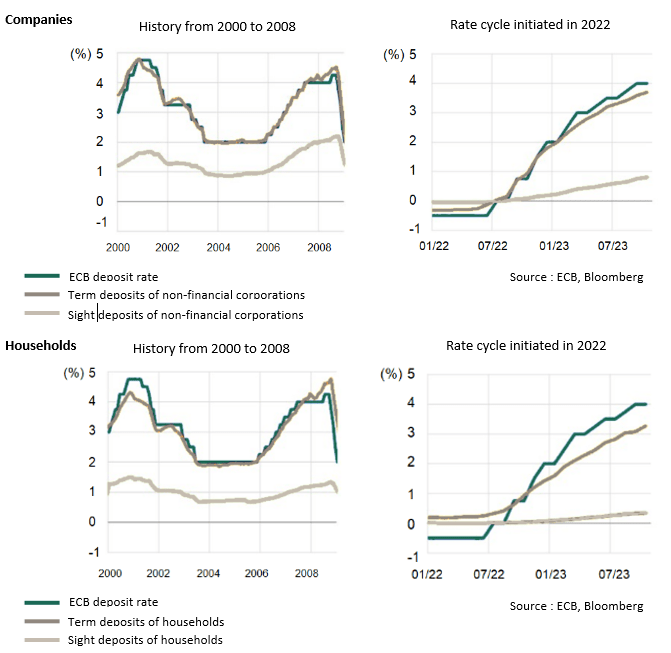

Changes in the ECB deposit rate and the remuneration of term and sight deposits held by companies and households in the euro zone

These graphs show a different dynamic in the impact of ECB deposit rate hikes on eurozone term deposits. During the monetary tightening cycles of the 2000s and the 2006-2008 period, term deposits followed the rise in rates relatively assiduously. In the latest cycle, however, which began in 2022, we can observe a delay that intensified from 2023 onwards. This phenomenon illustrates the ability of banks to reduce the beta of deposits in a context of friendly concentration in the sector and a favorable domestic regulatory environment, in order to optimize their financing costs and revenues linked to maturity transformation.

This phenomenon is all the more visible in household deposits, which remain the most important source of financing in Europe.

Financial subordinated bonds remain relatively protected

Greater impact on equities: Equities are the first to be affected by falling interest income, which impacts on their profitability. Mechanically, lower net income implies a reduced payout capacity, and therefore a lower return to shareholders (dividends and share buybacks).

Financial subordinated bonds are by definition a fixed-coupon debt instrument. As such, they are less sensitive to declines in profitability, especially as they are currently protected by banks' robust balance sheets and a restrictive regulatory framework. With banking fundamentals at an all-time high, whether at the level of common equity tier 1 (CET1) ratios, low levels of bad debts or high levels of profitability, combined with the current situation of excess capital and the prudence displayed by the banking supervisor (ECB), the sector's capacity to absorb potential losses has never been greater. These factors mean that bank debt, even subordinated debt, is relatively unexposed to the risk of default or non-payment of coupon in the medium term.

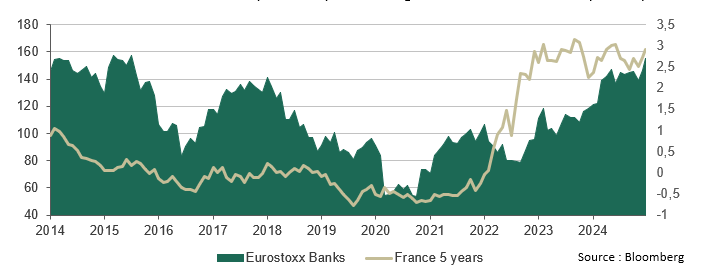

Trend in Eurostoxx Banks index and yield on 5-year French government bonds over the past 10 years

This chart shows the trend in the Eurostoxx Banks index and the yield on the 5-year French government bond, illustrating the impact of interest-rate trends on valuations in the banking sector. Medium- and long-term interest rates remaining at high levels would be beneficial for banking revenues.

The search for yield, a supporting factor: In periods of falling rates, investors are generally in search of yield. For example, between 2019 and 2021, falling interest rates in major economies led to significant inflows into higher-yielding financial subordinated bonds.

As an example, overall net bond market inflows1 in Europe fell from 223 billion euros to 185 billion between 2019 and 2021, a drop of 17%. At the same time, bank subordinated debt saw its net inflow rise from 1.2 billion euros to 6.9 billion over the same period, an increase of 460%.

A fall in government bond yields could thus be favorable to the asset class[1] inflows in response to investors' search for yield, offering a support factor for financial subordinated bond valuations

In conclusion, the fall in interest rates represents a challenge for banks, reducing their interest income, but this impact is largely mitigated by the hedging strategies put in place and an adjustment in operating expenses. For financial subordinated bonds, the consequences are thus limited, thanks to the solidity of bank balance sheets and strict regulations in Europe.

We are therefore positive on the asset class in 2025, which can play a relevant diversification role within an allocation in a carry strategy, with yields remaining on high levels at 6.66% as of January 15, 2025, for Additional Tier 1 (AT1)[2]bonds and 3.82% for Lower Tier 2[3]bonds.

Furthermore, the asset class generally benefits from investor interest during periods of low interest rates, which could provide technical support for valuations in the event of more rate cuts.

[1]AT1 bonds are financial instruments issued by banks as part of their regulatory capital structure under Basel III regulations to reinforce banks' financial stability. Data based on the ICE BofA Contingent Capital Index at 15/01/2024.

[1]LT2 bonds are subordinated debt instruments issued by banks to strengthen their regulatory capital under Basel III. They do not offer the same level of protection as Tier 1 capital, but constitute an additional capital reserve. Data based on the ICE BofA Euro Lower Tier 2 Corporate Index at 15/01/2024.

Principal risks: Risk of capital loss, Counterparty risk, Interest rate risk, Credit risk, Liquidity risk, Derivatives risk, Subordination risk.

Please refer to the prospectus for a full list of risks.

Risk indicator: 2/7

Recommended investment period: 4 years

Document written on 16/01/2025

Marketing communication

Disclaimer

Investing in this product involves risks. Every investor must be informed, before making any investment, by reading the prospectus and the key investor information document (KID) of the investment fund. These documents, which provide detailed information about risks and fees, as well as other periodic documents, can be obtained free of charge upon request from Groupama AM or at http://www.groupama-am.com.

Groupama Asset Management declines any responsability in case of alteration, deformation or falsification of this document. This document is intended solely for the use of its recipients. Any modification, use or distribution, in whole or in part, is forbidden. Groupama Asset Management shall not be held liable for any use that may be made of the document by a third party without its previous written authorisation.

The information regarding sustainability are available here.

The investment poses a risk of capital loss.

The information contained in this document is confidential and intended solely for the exclusive use of its recipients.

This document has been established on the basis of data, forecasts and hypothesis which are subjective. The analysis and conclusions lead to express an opinion, at a specific date, and based on a methodology proprietary to Groupama AM.

Considering the subjective and indicative nature of these analysis, they shall not be construed in any way whatsoever as an undertaking or guarantee on the part of Groupama Asset Management or a personalised recommendation. This non-contractual document does neither constitute a recommendation nor a solicitation, nor an offer to buy, sell or arbitrate, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its branches remain available to provide you with personalised service.

Published by Groupama Asset Management, an asset management company authorised by the AMF under registration number GP 93-02 - Registered office: 25 rue de la ville l'Evêque, 75008 Paris - Website: www.groupama-am.com

D