Marketing communication

Overview of the strategy : An opportunistic bond management strategy aimed at generating absolute performance with limited correlation to bond markets.

A strategy that stands out in uncertain times

While bond markets have experienced a sharp resurgence in volatility since the beginning of April, Groupama Alpha Fixed Income and Groupama Alpha Fixed Income Plus funds have demonstrated their resilience.

D. Trump's frequent—and sometimes contradictory—statements on tariffs targeting most of his trading partners have greatly increased uncertainty and nervousness among investors.

In this turbulent environment, our approach of maintaining very limited exposure to the fixed income and credit markets has proven successful for our Groupama Alpha Fixed Income and Groupama Alpha Fixed Income Plus funds.

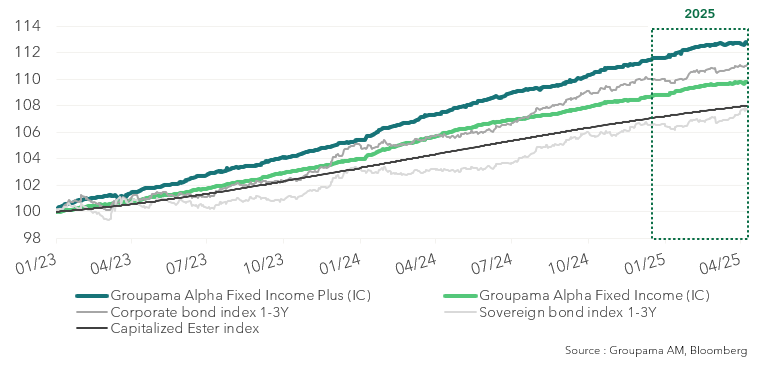

The chart highlights the strong performance of our funds since the launch of the Groupama Alpha Fixed Income Plus strategy, compared with both sovereign and corporate bond indices1.

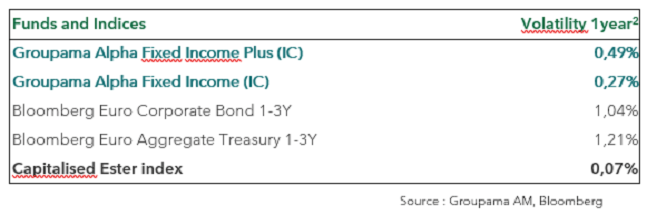

A focus on the start of the 2025 financial year (green box on the chart) shows that bond indices for government bonds and corporate credit were more volatile, exposing investors to market fluctuations. Over one year, the situation is the same, with limited volatility in our funds

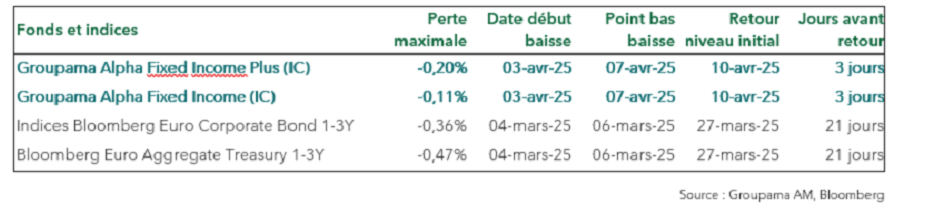

The maximum drawdown of these various investment vehicles since the beginning of 2025 has thus been lower across our absolute performance funds, with a much faster return to initial levels.

Past performance, including the drawdown periods shown above, is not indicative of future performance.

Our funds Groupama Alpha Fixed Income and Groupama Alpha Fixed Income Plus delivered on their promise of very limited exposure to market fluctuations, confirming their key role within an allocation during periods of high uncertainty. This strategy therefore responds to the needs of vigilant investors who are seeking to generate positive returns regardless of market conditions over the recommended investment period.

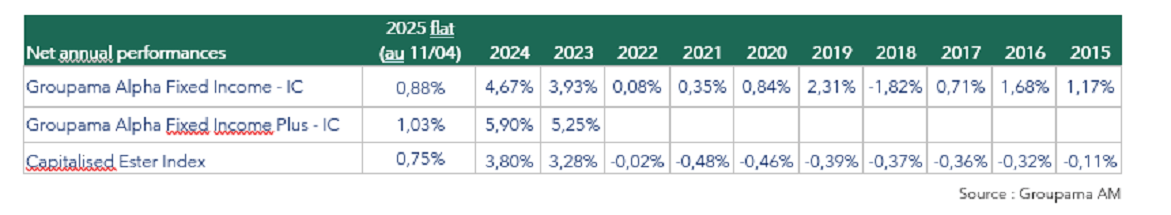

Performances of Groupama Alpha Fixed Income and Groupama Alpha Fixed Income Plus

Past performance is not a guide to future performance and is not constant over time.

The strategy of the Groupama Alpha Fixed Income funds range is based on the management of two distinct pockets:

• A Core Pocket composed mainly of high-quality short-maturity bonds to optimize the risk-return balance and ensure portfolio liquidity.

• An Alpha Pocket with the objective of delivering absolute performance through arbitrage strategies on the fixed-income and equity markets (in the case of Groupama Alpha Fixed Income Plus).

At the same time, the fund management team seeks to maintain very limited exposure to interest rate and credit risks.

2 Volatility over a one-year horizon based on weekly performance calculations, as at 11/04/2025

Main risks: Risk of capital loss, Interest-rate risk, Credit risk, Liquidity risk, Risk of investing in derivatives.

Please refer to the prospectus for a full list of risks.

Source of data: Bloomberg

Risk indicator: 2

This indicator represents the risk profile shown in the KID. The risk category is not guaranteed and may change during the month.

Recommended investment period: 18 months

Document written on 22/04/2025

Disclaimer

Investing in this product involves risks. Every investor must be informed, before making any investment, by reading the prospectus and the key investor information document (KID) of the investment fund. These documents, which provide detailed information about risks and fees, as well as other periodic documents, can be obtained free of charge upon request from Groupama AM or at www.groupama-am.com.

Groupama Asset Management declines any responsability in case of alteration, deformation or falsification of this document. This document is intended solely for the use of its recipients. Any modification, use or distribution, in whole or in part, is forbidden. Groupama Asset Management shall not be held liable for any use that may be made of the document by a third party without its previous written authorisation.

The information regarding sustainability is available here.

The investment poses a risk of capital loss.

The information contained in this publication is based on sources that we consider reliable, but we do not guarantee that it is accurate, complete, valid, or timely.

This document has been established on the basis of data, forecasts and hypothesis which are subjective. The analysis and conclusions lead to express an opinion, at a specific date, and based on a methodology proprietary to Groupama AM.

Considering the subjective and indicative nature of these analysis, they shall not be construed in any way whatsoever as an undertaking or guarantee on the part of Groupama Asset Management or a personalised recommendation.

Examples for illustrative purposes. These information does not constitute in part or whole, an offer, a personalised recommendation or solicitation in the products or investments services proposed.

This non-contractual document does neither constitute a recommandation nor a solicitation, nor an offer to buy, sell or arbitrate, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its branches remain available to provide you with personalised service.

Published by Groupama Asset Management, an asset management company authorised by the AMF under registration number GP 93-02 - Registered office: 25 rue de la ville l'Evêque, 75008 Paris - Website : www.groupama-am.com.