Summary

• Issuers took advantage of favorable market conditions to complete most of their refinancing programs in the first half of 2024. The pace of issuance may therefore remain dynamic but be more modest towards the end of the year.

• At the same time, we continue to see strong inflows into bond assets, supported by the prospect of rate cuts in both Europe and the United States. At the end of May, inflows to the Euro Investment Grade credit markets (companies rated BBB- or better) stood at 15.5 billion euros, compared with 13 billion euros for the whole of 2023. With the European Central Bank (ECB) having cut rates for the first time on June 6, investors' appetite for bonds is likely to remain high as they seek to capture attractive yields.

• This strong demand, combined with a primary supply that may be gradually slowing, could become a factor supporting bond market valuations.

Positive financing conditions have been maintaining the momentum

The positive economic data for the first five months provided a positive environment for the European primary market, with issuers keen to move forward their financing programmes as much as possible in fear of a deterioration in these conditions:

• A process of disinflation has begun, with headline inflation in the eurozone falling from 2.9% at the end of December to 2.6% at the end of May. At the same time, core inflation, i.e. excluding the most volatile components such as energy and food, also fell from 3.4% to 2.9%.

• The rebound in growth in the Eurozone, higher than consensus expectations (+0.3% vs. +0.1% expected in the first quarter), with encouraging data in the industry.

• Equity markets at record levels, with low volatility until the tensions surrounding the European elections.

• The first rate cut confirmed by the ECB, reducing its deposit rate from 4% to 3.75%.

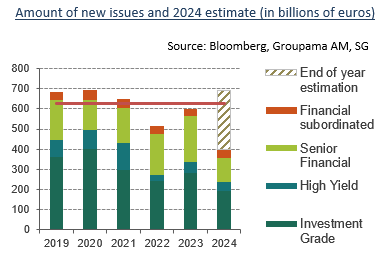

Against this backdrop, bond issuance reached almost 400 billion euros, almost 30% above its five-year average.

For corporate bonds, May was even the highest on record (83.1 billion euros in Investment Grade bonds and 20.1 billion in high yield bonds).

A global positive trend in the bond asset class

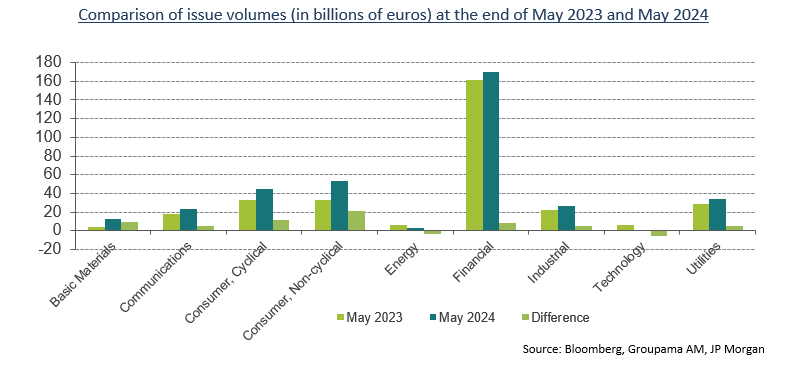

While this good momentum extends to a majority of sectors, there are still major disparities compared to May 2023. The most prominent sectors on the primary market were basic materials (+216% year-on-year), cyclical and non-cyclical consumer goods (+65% and +35% respectively) and telecommunications (+31%). Conversely, the number of issues from the energy and technology sectors was much more limited compared to the same period in 2023 (volumes down by 51% and 92% respectively). The absence of euro-denominated issues from the American IBM in 2024 explains the sharp drop in the technology sector.

Although the offering was substantial, investors generally responded to the start of the year, with some issuers having already issued several times, such as German utility company E.ON and American carmaker Ford.

This positive trend is also reflected in the various credit rating segments of European issuers, with issue volumes at the end of May of over 45 billion euros for high yield bonds, compared with a 5-year average of 32 billion. For corporate bonds of good credit quality, the 2024 volume was €191 billion, compared with an average of €161 billion.

Strong demand for corporate issues with high credit quality

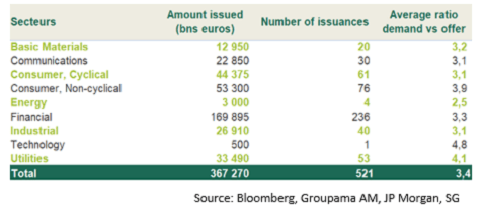

Particularly sought-after by investors, Investment Grade (IG credit) corporate issues were mostly oversubscribed, sometimes many times over. This interest was partly due to the large pockets of cash available with investment funds, and the positive economic outlook for the asset class.

As shown in the table opposite, IG credit issues were oversubscribed by an average of 3.4 times the amount issued.

Unsurprisingly, Infineon's issue, the only one in the technology sector, was subscribed almost 5 times its nominal value, well above the average

Another example is French company Alstom's hybrid debt issue, for which demand amounted to almost 8 billion euros, with an offer of only 750 million euros.

Pressure on issue premiums

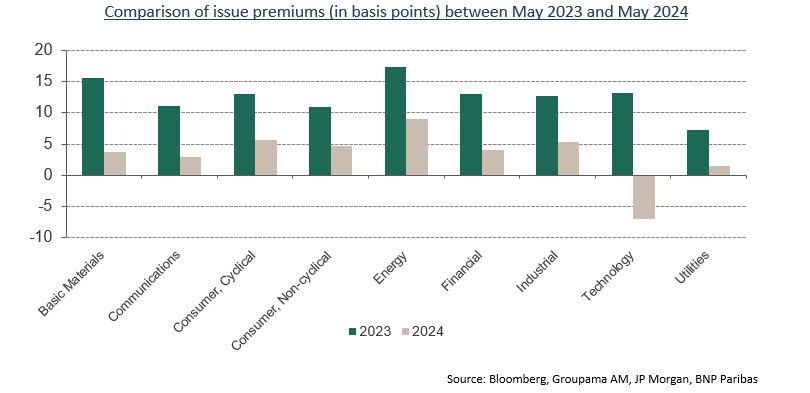

With demand on the primary market showing few signs of weakening at the end of May, issuers are able to offer their bonds at more moderate issue premiums. As a result, there is a downward trend in 2024 compared with the previous year.

As can be seen from the chart, all sectors are affected by the fall in premiums, particularly technology with the single issue of Infineon (semiconductor producer) mentioned above. Although the trend is downward, the five-month average remains positive, with an average premium of 4 basis points.

Issuers have also strongly advanced their 2024 issuance programs, as is the case for Portugal (91%) and the Netherlands (69%) on sovereign debt (average of 55% for the eurozone, i.e. 8% more than at the same time in 2023). The dynamism of these issues, combined with a demand for bonds that is likely to remain strong in view of the ECB's forthcoming decisions, could limit the upward potential of these issue premiums over the remainder of the year. On the other hand, this imbalance between supply and demand on the bond market could become a support factor for valuations.

Issues that support our investment strategies

The dynamism of the primary market is of great interest to our various strategies. In particular, our hybrid debt and absolute return funds are taking distinct advantage of these issues.

Hybrid debt: our corporate hybrid bond fund seeks to benefit from the issue premiums we consider attractive on certain bonds in the primary market. Access to these issues enables us to increase portfolio yields when market conditions are right, as has been the case since 2022 with the return of high coupons in line with rising interest rates.

By way of example, the weighted average coupon on new euro-denominated corporate hybrid issues was 3.04% between 2017 and 2021, rising to an average of over 5.50% between 2022 and 2024.

Absolute performance: our absolute performance funds, Groupama Alpha Fixed Income and Groupama Alpha Fixed Income Plus, also benefit from the return of higher coupons and sometimes attractive premiums in their investment universe. These issues feed into the portfolio's core pocket, with the aim of optimizing the fund's risk/return profile and guaranteeing the liquidity needed to deploy alpha strategies.

The alpha pocket, for its part, benefits from the primary market through the implementation of relative pricing strategies, aimed at establishing positions between bonds issued and interest-rate and credit-risk hedging products, with the objective of holding them until their valuation better reflects their fundamentals.

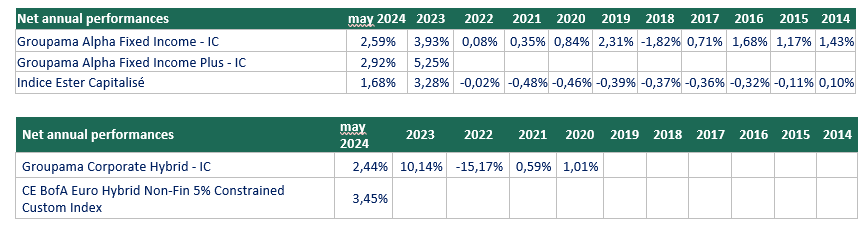

Performance of hybrid corporate bond and absolute return funds

The names of the funds were changed on 24/06/24. The previous names were respectively: G Fund - Alpha Fixed Income, G Fund - Alpha Fixed Income Plus and G Fund - Hybrid Corporate Bonds.

Past performance is no guarantee of future performance and is not constant over time.

Find out more about Groupama AM's hybrid corporate bond and absolute performance funds:

• Groupama Corporate Hybrid IC : LU2023296168 – Institutional share

• Groupama Alpha Fixed Income IC : LU0571101715 – Institutional share

• Groupama Alpha Fixed Income Plus IC : LU2550878602 – Institutional share

Document written on 01/07/2024

Main risks: Risk of capital loss, Interest-rate risk, Credit risk, Risk associated with hybrid or subordinated securities, Liquidity risk, Risk associated with investment in derivatives.

Please refer to the prospectus for a full list of risks.

Data sources: Bloomberg, Groupama AM, SG, JP Morgan, BNP Paribas

Disclaimer

For professional investors only, as defined by MiFID. This is a marketing communication. Please refer to the prospectus/key investor information document before making any final investment decisions.

Investing in this product involves risks. Every investor must be informed, before making any investment, by reading the prospectus and the key investor information document (KID) of the investment fund. These documents, which provide detailed information about risks and fees, as well as other periodic documents, can be obtained free of charge upon request from Groupama AM or at www.groupama-am.com.Groupama Asset Management declines any responsability in case of alteration, deformation or falsification of this document. This document is intended solely for the use of its recipients. Any modification, use or distribution, in whole or in part, is forbidden. Groupama Asset Management shall not be held liable for any use that may be made of the document by a third party without its previous written authorisation. Past performance does not predict future returns and may vary over time. The investment poses a risk of capital loss. The information contained in this publication is based on sources that we consider reliable, but we do not guarantee that it is accurate, complete, valid, or timely. The analysis and conclusions are the expression of an independent opinion of Groupama Asset Management, based on available data at a specific date. This document has been established on the basis of data, forecasts and hypothesis which are subjective. The analysis and conclusions lead to express an opinion, at a specific date, and based on a methodology proprietary to Groupama AM. Considering the subjective and indicative nature of these analysis, they shall not be construed in any way whatsoever as an undertaking or guarantee on the part of Groupama Asset Management or a personalised recommendation. This non-contractual document does neither constitute a recommendation nor a solicitation, nor an offer to buy, sell or arbitrate, and should not be interpreted as such.

Published by Groupama Asset Management, an asset management company authorised by the AMF under registration number GP 93-02 - Registered office: 25 rue de la ville l'Evêque, 75008 Paris - Website: www.groupama-am.com.