Overall, GDP growth came in stronger than we had anticipated: +5.4% year-on-year (vs. +5.0% in our March 2025 forecast).

Such a performance is encouraging news for the authorities and provides some leeway to reach this year’s GDP growth target of around 5%. However, we remain cautious. This strength in activity is likely to be temporary, and the toughest challenges still lie ahead for the Chinese economy:

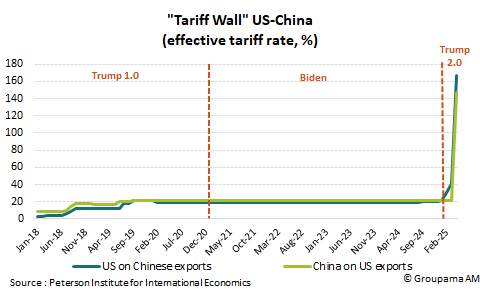

On the one hand, it has been artificially boosted by export frontloading in anticipation of stricter tariff measures. The external outlook will deteriorate further in the coming months. Since early April, the United States has imposed new tariff hikes on imported Chinese goods, bringing the effective tariff rate to 167% (see Chart 3). According to our estimates, such a level would directly reduce GDP by about 4 percentage points, if no negotiations take place or if trade flows are not redirected.

On the other hand, it has been supported by government stimulus efforts. Notably, since the beginning of the year, China has introduced a series of measures aimed at expanding its consumer goods exchange program to stimulate domestic demand. The most concrete of these is the allocation of an additional 300 billion yuan to support subsidies for the purchase of new cars, smartphones, or home appliances. However, such measures cannot sustainably support consumption.

In this context, as the United States and China have entered a new phase of confrontation and a quick resolution is unlikely in the near future, what will Beijing do to preserve "economic stability"?

We believe the authorities will continue to follow a pragmatic and reactive approach:

Monetary policy: The decline in export activity due to tariffs and deflationary pressures will justify new, though cautious, actions to maintain financial stability: a further 100 basis-point cut in banks’ reserve requirement ratios this year and gradual reductions in interbank interest rates.

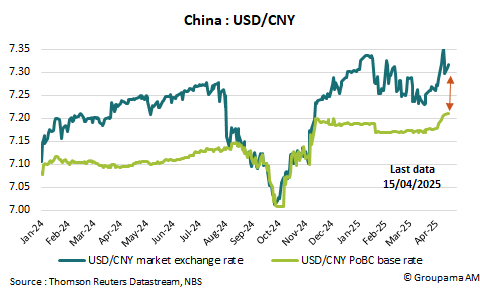

Exchange rate policy: The central bank has no reason to carry out a sharp devaluation of the currency. Financial stability remains a key policy goal, justifying the relatively stable reference parity so far and its peg at a stronger level than the market rate, despite the increase in U.S. tariffs (see Chart 4). A sudden devaluation could ultimately accelerate capital outflows and reduce the value of foreign exchange reserves, as seen in the 2015–2016 episode. However, we do not rule out a gradual devaluation to maintain competitiveness, support growth, and preserve financial stability.

Fiscal policy: A new stimulus plan is expected, likely at the upcoming Politburo meeting in July. If tariffs remain in place as announced since April 2 and data show a sharp slowdown, Beijing may approve a stimulus package equivalent to at least 2.5% of GDP to offset the impact of tariffs on Chinese exports. Support for consumption will be a top priority.

Structural reforms: While stimulus measures may help boost China’s domestic demand in the short term, structural reforms are still needed to rebalance the growth model. The trade war could force authorities to accelerate this process, particularly by improving the social safety net to reduce precautionary savings. However, this is not currently on the agenda.

In conclusion, we are maintaining our growth forecasts at this stage: 4.5% in 2025 and 4% in 2026, based on the assumption that negotiations will take place and succeed. These forecasts will be revised down by at least 1 percentage point if the tariff increases announced since April 2 remain in place.