The annual session of the National People's Congress – the Chinese Parliament – opened today. On this occasion, the government of Prime Minister Li Qiang is presenting a report on the activities of the year 2024, on the one hand, and unveiling the key aspects of the planned economic policy for 2025, on the other.

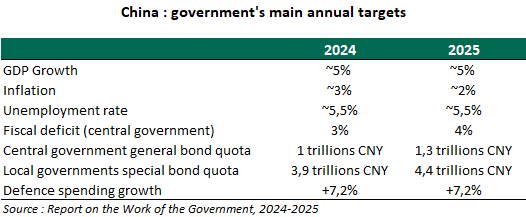

Overall, few surprises were observed (see table below). The Prime Minister reiterated the annual growth target of around 5% for this year. However, he acknowledged that it would be difficult to achieve given the current macroeconomic context. Indeed, on a global scale, "unprecedented transformations in a century have accelerated." The economy now faces an "increasingly complex and severe external environment" that "could have a greater impact on China in areas such as trade, science, and technology." Domestically, too, "the foundations of China's recovery and sustainable economic growth are not sufficiently solid. Effective demand is weak, and in particular, consumption remains sluggish."

In this context, the roadmap spans several areas. Domestic demand is becoming the "driving force" and the "anchor point" of growth. Other strategic priorities and levers include: developing and modernizing industry, promoting education and innovation, encouraging structural reforms, increasing market openness, and preventing risks in key areas such as the real estate market, local debt, and risks related to small regional banks.

To strengthen domestic demand, China will implement:

A "stronger and more effective" fiscal policy, including:

- A budget deficit set at 4% of GDP (compared to the conventional ceiling of 3% of GDP so far).

- An ultra-long-term government bond issuance quota of 1.3 trillion yuan (compared to 1 trillion in 2024), with 300 billion allocated to expanding consumer goods renewal policies and approximately 100 billion for pension and healthcare expenditures.

- The issuance of special local government bonds amounting to 4.4 trillion yuan (compared to 3.9 trillion in 2024).

A moderately accommodative and flexible monetary policy, with future reductions in interest rates and reserve requirement ratios for banking institutions.

Incentive measures to improve living conditions and public well-being, including "targeted measures" related to holidays, duty-free shops, and foreign consumption. However, no details or timeline were provided regarding the "various means" to increase the income of low-income households or strengthen the social protection system.

Li Qiang’s speech and today's announcements demonstrate that the authorities acknowledge the risks the Chinese economy will have to face. The message is clear. In response to downward pressures on growth (trade conflicts, weak domestic demand), Beijing is ready to support the economy. By maintaining the annual growth target at around 5% for 2025, the authorities express confidence in their ability to steer and manage economic developments successfully.

However, we remain cautious about this year’s growth trajectory. Even with such a proactive policy mix, achieving the 5% target is debatable. In 2024, reaching this goal was challenging and was only made possible thanks to exports and stimulus measures introduced late in the autumn. This year, external headwinds are even stronger. The trade war with Washington has intensified. Even though China is better prepared, the new tariffs introduced by the Trump administration create additional uncertainty, disrupting the business climate. This comes at a difficult time when the authorities are struggling to implement substantial measures to address structural weaknesses and reduce precautionary savings.

In this context, we maintain our scenario of a gradual slowdown in activity. Growth is expected to be around 4.5% in 2025, after 5% in 2024.