1. The Dollar Must Decline

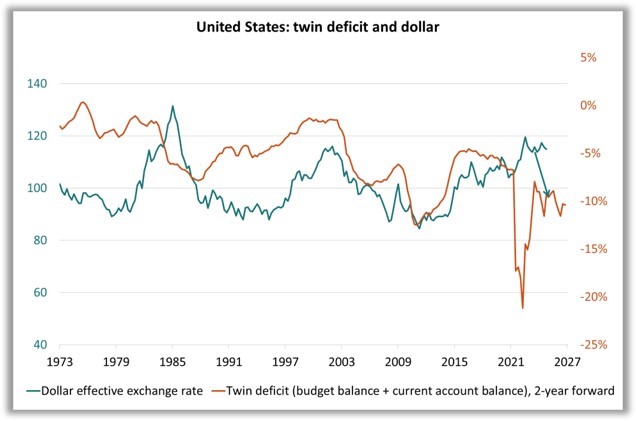

In the United States, the persistence of the “twin deficits”—namely the combination of a budget1 deficit and an external imbalance—creates downward pressure on the dollar (see Chart 1). In particular, the external imbalance stems from excessive consumption, which mirrors a lack of savings. The low savings rate becomes problematic at a time when financing needs are high to support economic transitions. Consequently, it will become more difficult for the U.S. to attract foreign savings, as the funding countries (notably Europe) now need their own savings to finance their own transitions.

In addition to these structural imbalances, two challenges are emerging that could weigh on the currency:

- First, a growing concern about the rule of law, which is problematic in a financialized economy.

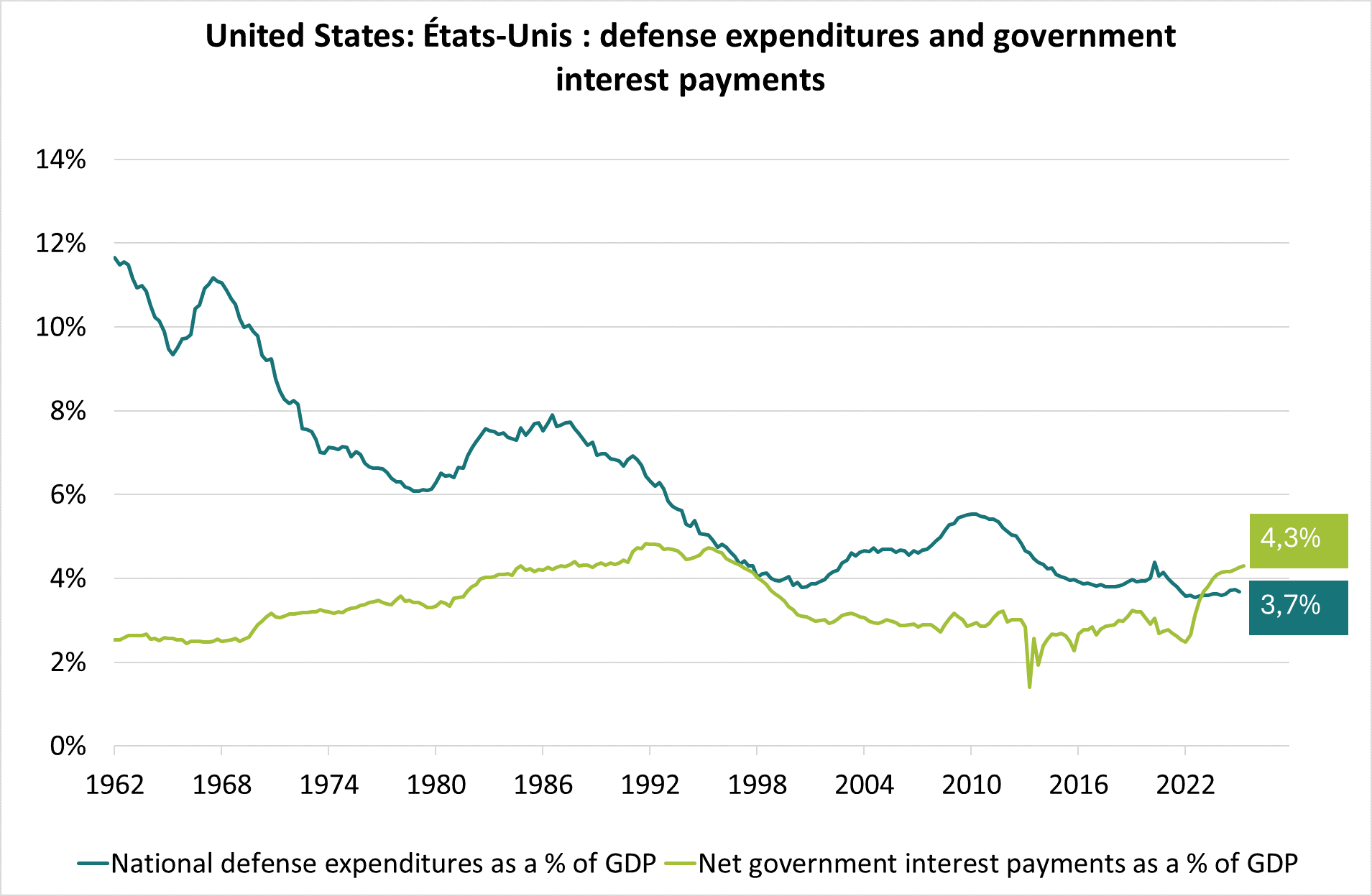

- Second, a rising question about the sustainability of American global leadership. In this regard, British historian Niall Ferguson argues that a leading country on the international stage enters a phase of decline when it begins to spend more on debt servicing than on defense2. The United States has been in this situation for the past year (see Chart 2), signaling a challenge to maintaining its global leadership.

Source: Bloomberg – Calculations: Groupama AM

2. The Downside Potential Is Around 30%

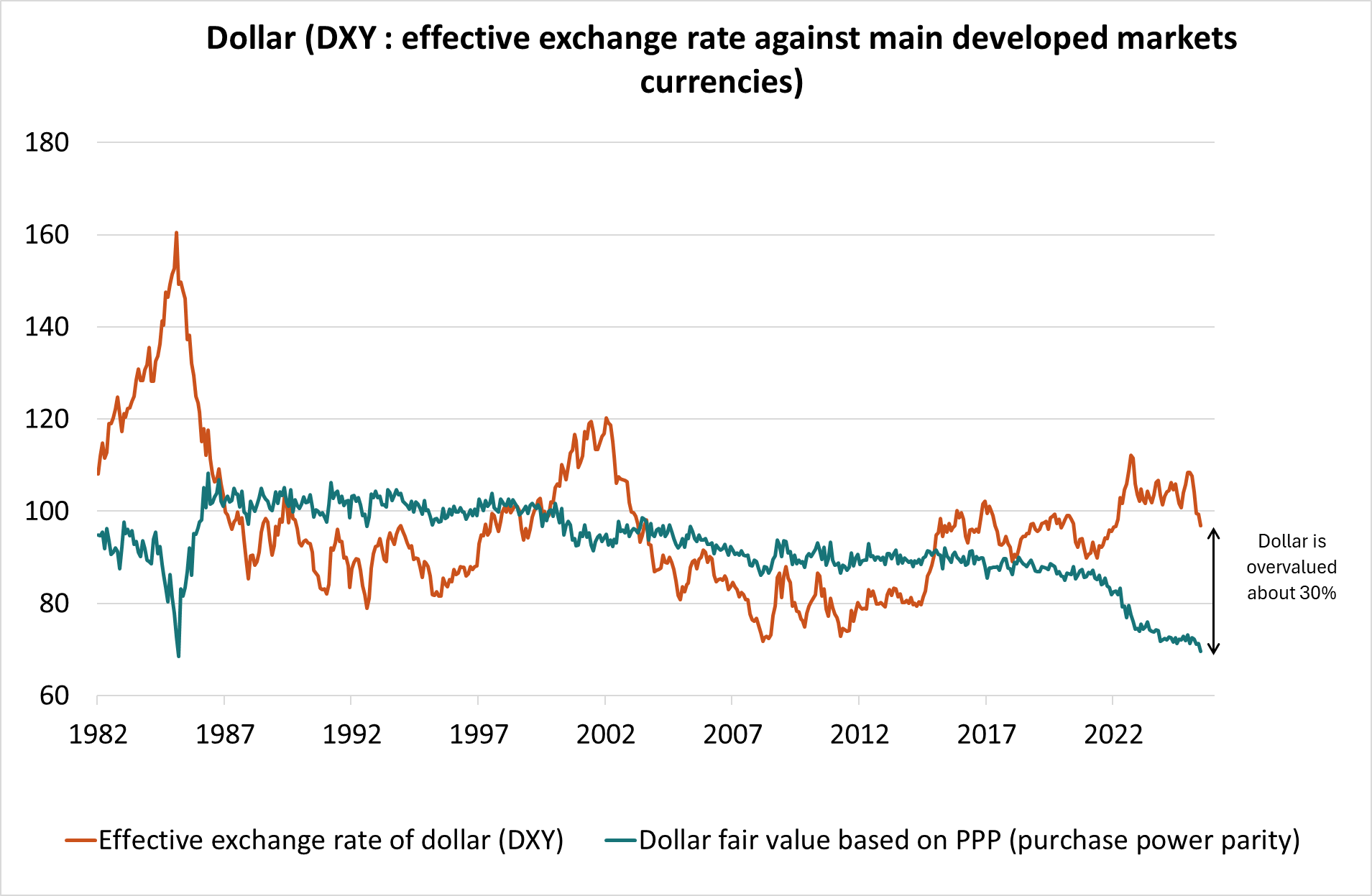

Based on purchasing power parity (PPP), the dollar is currently overvalued by about 30% against the main developed market currencies (see Chart 3). This metric serves as a relevant medium-term anchor. Indeed, valuation gaps between the dollar and its equilibrium value as defined by PPP (dark green line in Chart 4) are an effective predictor of future dollar movements (light green line in Chart 4).

Source: Bloomberg – Calculations: Groupama AM

3. The Decline Will Occur in Stages

The dollar’s adjustment will unfold over time, bearing in mind that past appreciation and depreciation cycles have spanned several years (ranging from 6 to 13 years since the early 1970s – see Chart 5). This decline will therefore occur in stages. Since its peak in January 2025, the dollar has fallen by nearly 12%. However, if we take as a reference the trading range in which the dollar has fluctuated since 2023, the decline is more moderate, around 6%.

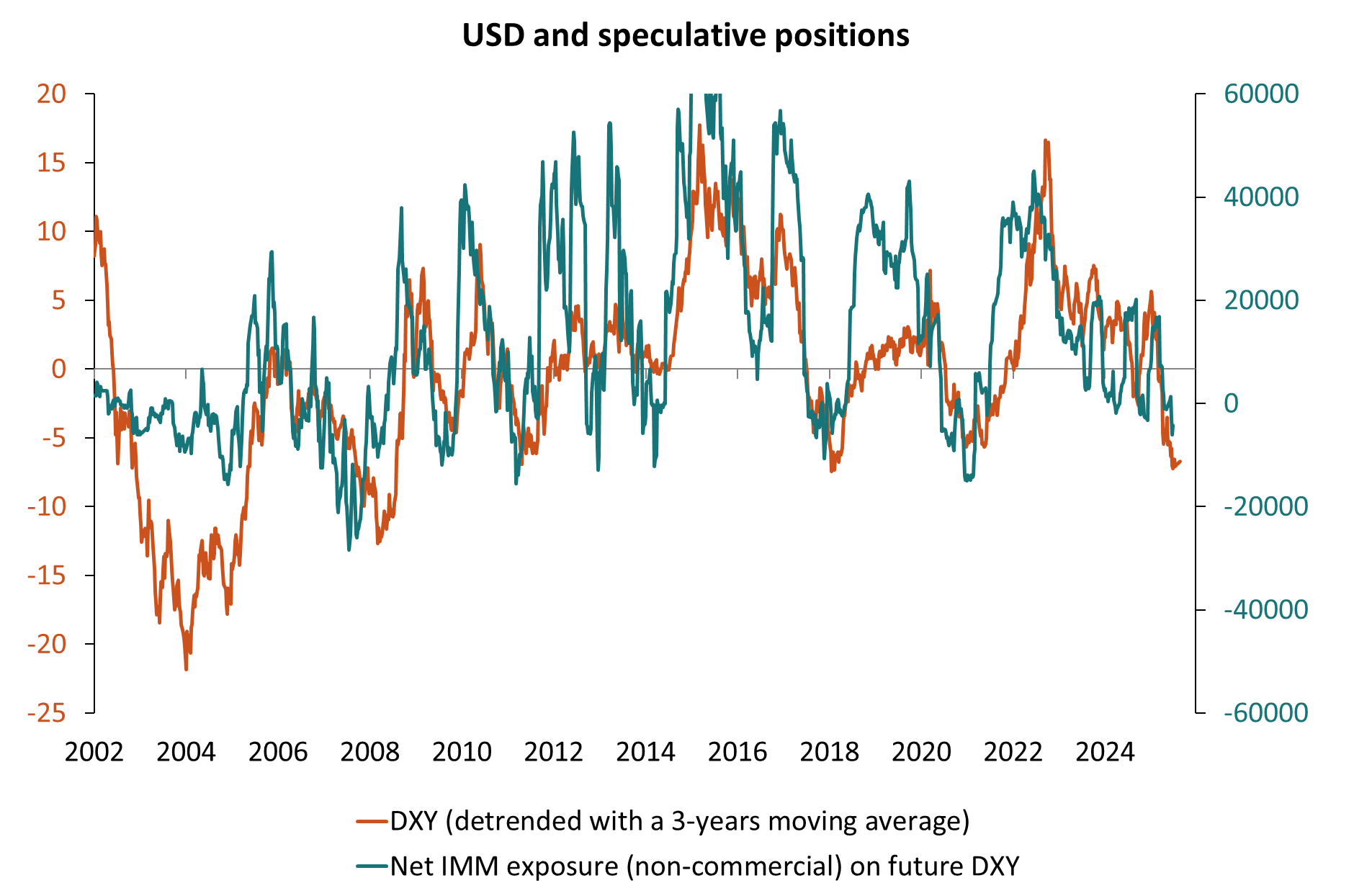

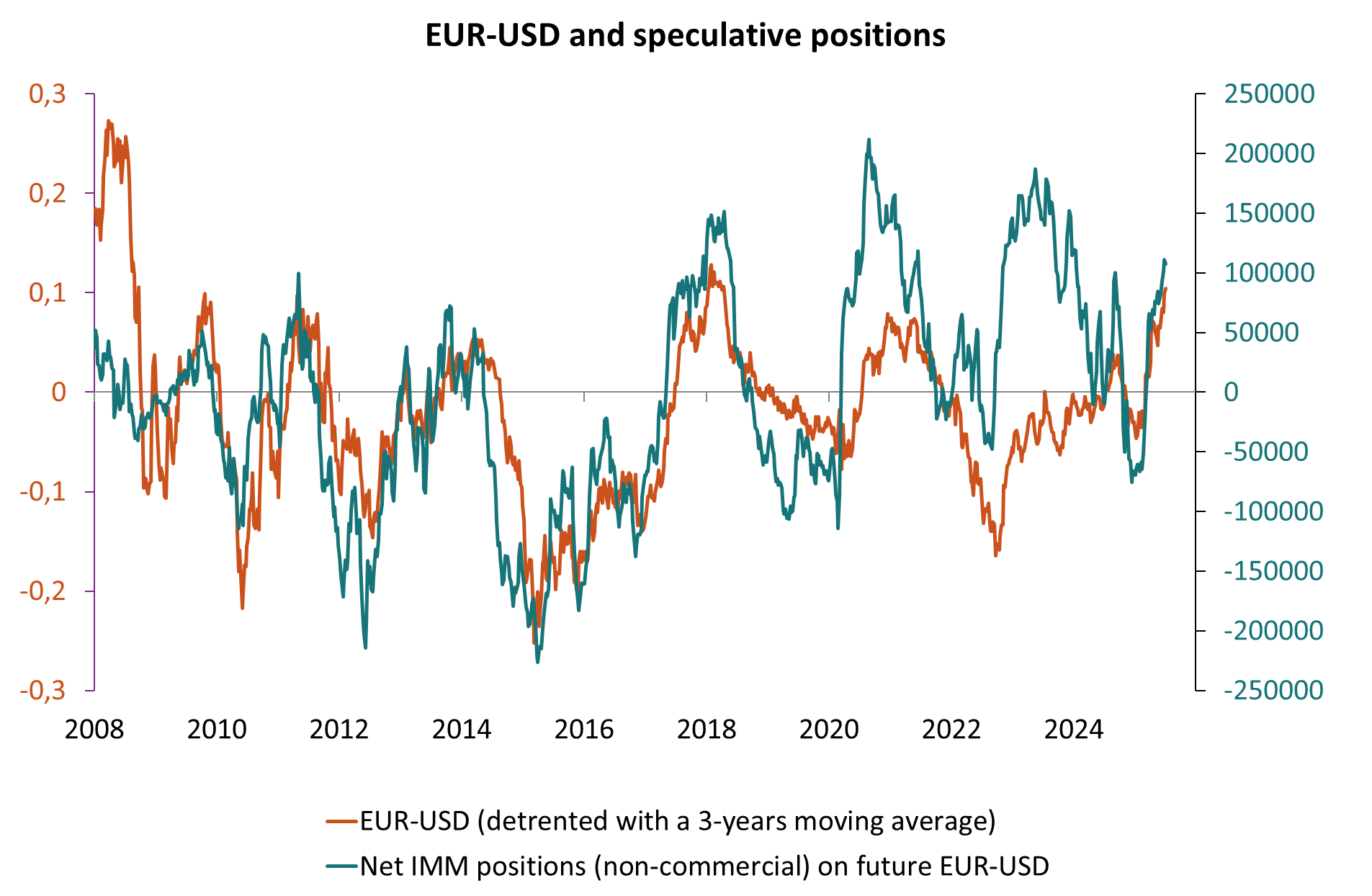

The first pause in this downward trend will likely be signaled by speculative positioning, which could indicate a risk of unwinding or, at the very least, an asymmetric risk. At this stage, speculative positions are not yet excessively short on the dollar and long on the euro, but they are approaching that point—suggesting the prospect of a first plateau in the dollar’s downward movement (see Charts 6 & 7).

Source: Bloomberg – Calculations: Groupama AM

4. The Next Stage of the Dollar’s Decline Could Be a “Test of the Exorbitant Privilege”

So far, the dollar’s “exorbitant privilege” has not been tested:

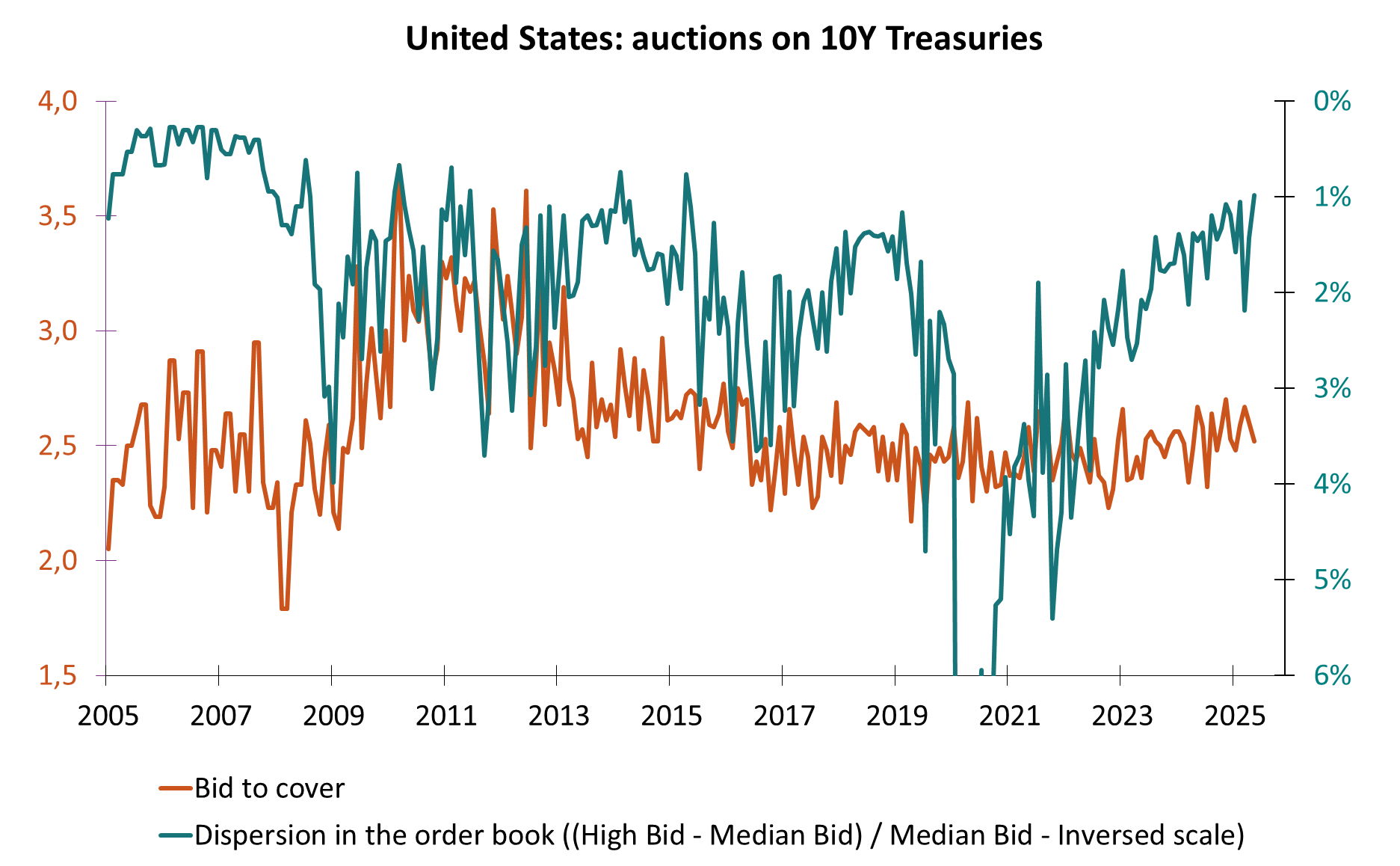

- On the one hand, primary market auctions remain comfortably oversubscribed, as shown by the Bid-to-Cover ratio (which compares demand to the amount issued – green line in Chart 8) and by the dispersion in the order book (red line in Chart 8).

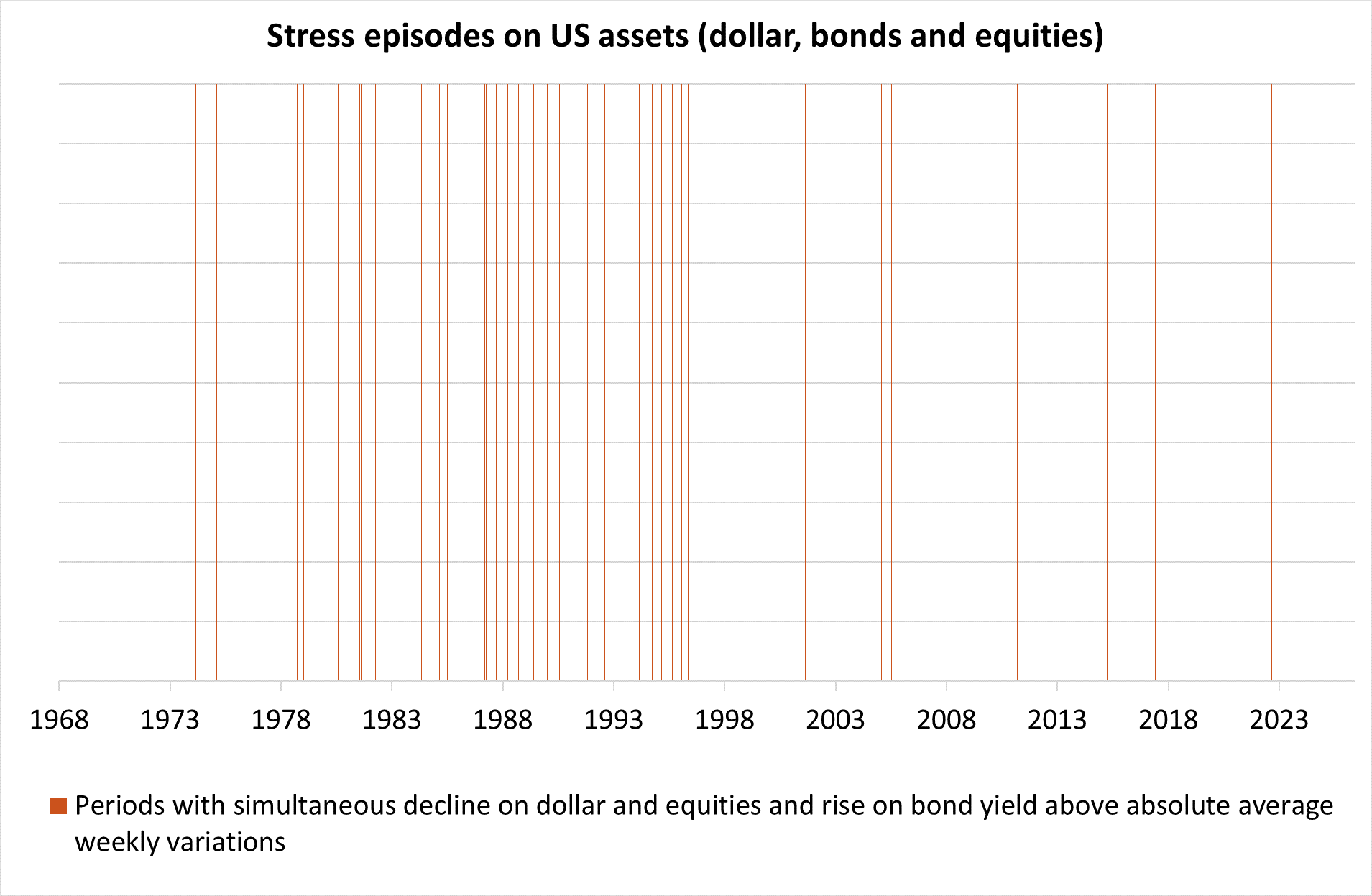

- On the other hand, there has not yet been a scenario combining a significant drop in both the dollar and equities alongside a sharp rise in interest rates—an event that would raise concerns about the sustainability of U.S. public finances (see Chart 9).

However, the Treasury market is now vulnerable to a disappointing outcome in a primary auction. Such an event is bound to occur at some point and would likely act as a catalyst for a new downward leg in the dollar’s trajectory.

Source: Bloomberg – Calculations: Groupama AM

2 “Colossus: The Rise and Fall of the American Empire” (2004).

DISCLAIMER

This document is intended exclusively for informational purposes.

Groupama Asset Management and its subsidiaries disclaim all liability in the event of any alteration, distortion, or falsification of this document. Any unauthorized modification, use, or distribution, in whole or in part, in any form whatsoever, is prohibited.

Before making any investment, investors must read the prospectus or the Key Information Document (KID) of the fund. These documents, along with other periodic reports, are available free of charge upon request from Groupama AM or at www.groupama-am.com.

This non-contractual material does not constitute, under any circumstances, a recommendation, a solicitation, or an offer to buy, sell, or arbitrate, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized investment advice.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com