As expected, the Governing Council decided to lower its key interest rates by 25bps, i.e. the deposit rate, the refinancing rate and the facility rate, to 2.50%, 2.65% and 2.90% respectively. The ECB is maintaining its “data dependent” approach, meeting by meeting, and is not committing in advance to a particular rate path. However, the ECB has adjusted its assessment of the level of restrictiveness of its monetary policy from “restrictive” to “meaningfully less restrictive”, suggesting that we are approaching a “pause”, in line with our scenario.

Key takeaways:

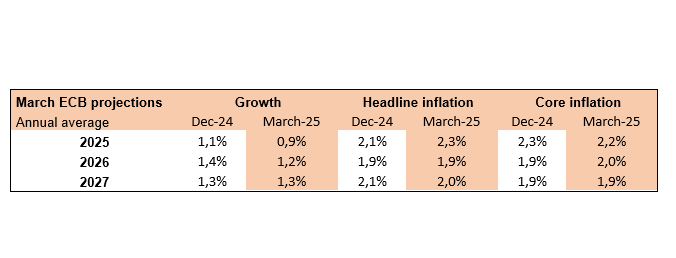

- The disinflation process is well on track and inflation has been broadly in line with the ECB’s expectations (see forecast table).

- Growth forecasts maintain a recovery but more gradual due to the exceptionally high level of uncertainty (see forecast table).

- Monetary policy is becoming significantly less restrictive: this is reflected in observable data such as growth in loans to firms and households.

- The “phenomenal” level of uncertainty leads the ECB to remain “vigilant” and “agile”; the ECB is scrutinizing the data “more than ever”; data dependency and the meeting-by-meeting approach were the key themes of the press conference.

- There was no discussion on balance sheet reduction (QT); the adjustment continues to be gradual as planned. The main tool of monetary policy remains interest rates.

Our assessment: The ECB President remained deliberately vague during the press conference. The level of uncertainty described as “phenomenal” encourages the ECB to maintain the vagueness regarding a possible pause at the next Governing Council on April 17th. Recent fiscal policy decisions in the Euro area, and more specifically in Germany, are not yet included in the ECB’s forecasts but are likely to boost growth. A more active involvement of fiscal policy is good news for the ECB as it will loosen constraints on monetary policy. Overall, the ECB could give itself time to monitor geopolitical developments, observe the effects of US trade policy and have the details of recent fiscal plans.

DISCLAIMER

This document is intended for informational purposes only.

Groupama Asset Management and its subsidiaries disclaim any liability in the event of alteration, distortion, or falsification of this document. Any unauthorized modification, use, or distribution, in whole or in part, in any form whatsoever is prohibited.

Before making any investment, investors must review the prospectus or the Key Investor Information Document (KIID) of the UCITS. These documents, along with other periodic reports, are available free of charge upon request from Groupama AM or at www.groupama-am.com.

This non-contractual document does not constitute a recommendation, a solicitation, or an offer to buy, sell, or trade, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized recommendations.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com