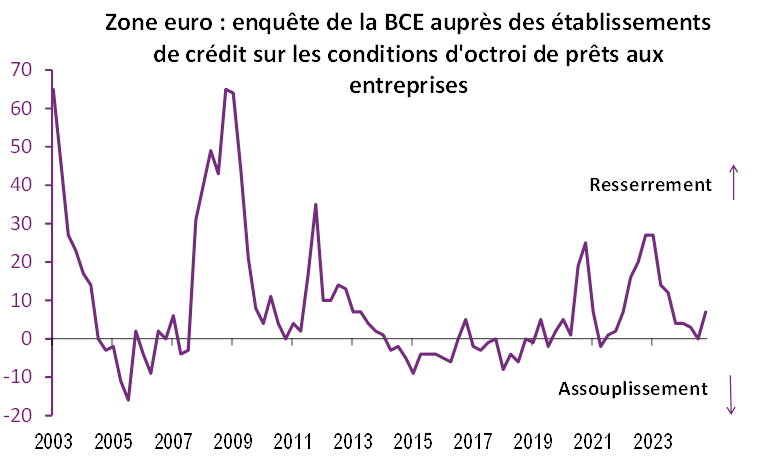

The ECB (*) survey on banking conditions in the fourth quarter of 2024 in the euro area, published today, reports a renewed tightening of loans to businesses after a steady improvement over the past year (see Graph 1). Banks' cautiousness in lending is explained by the increase in perceived risks related to economic outlooks and their low risk tolerance. Meanwhile, lending conditions for household loans have remained broadly unchanged after three quarters of easing. Corporate credit demand continued to increase slightly in Q4 2024 but remains weak, whereas household loan demand remained strong.

In detail, the survey shows that credit supply conditions for businesses tightened in France and Germany in the fourth quarter, while they eased in Italy. Several factors explain this prudence, such as risk tolerance, economic outlooks, and heightened political uncertainty in France and Germany. Banks expect further tightening in Q1 2025.

On the household side, banks report unchanged conditions for home loans but a new tightening for consumer credit. Competition among banks has favored lending conditions for home purchases, whereas risk tolerance and risk perception have had a tightening effect on lending criteria. As previously observed, the improvement has largely been driven by developments in France for the fourth consecutive quarter. Banks anticipate a tightening of credit conditions for households in Q1 2025.

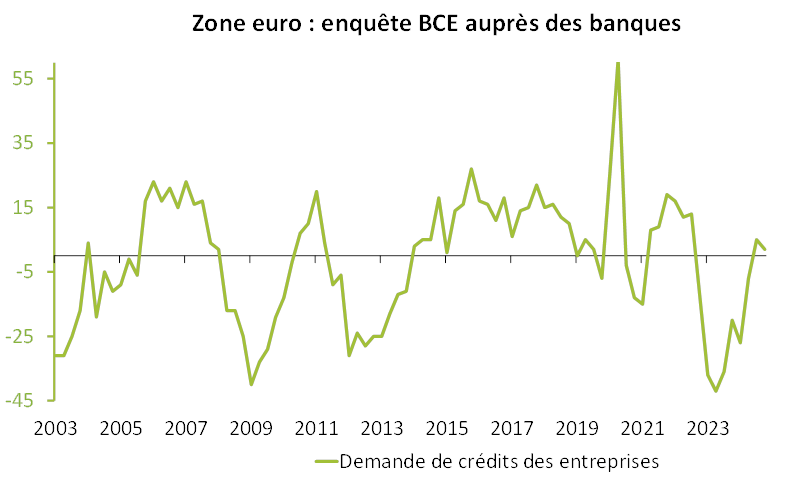

On the demand side, banks report a slight increase in net demand for business loans in Q4 2024, mainly driven by lower interest rates (see Graph 2). However, demand remains weak and reflects the persistent economic downturn, particularly in investment-intensive sectors. Some banks also cite economic and (geo)political uncertainties as moderating factors for corporate loan demand. Significant disparities are observed between countries: loan demand is rising in Germany, Spain, and Italy, while it is sharply declining in France. Banks expect overall unchanged loan demand in Q1 2025.

Regarding households, demand for home loans continued to rise sharply, also mainly driven by lower interest rates. This increase in demand was widespread across all euro area countries. Banks anticipate further demand growth in Q1 2025.

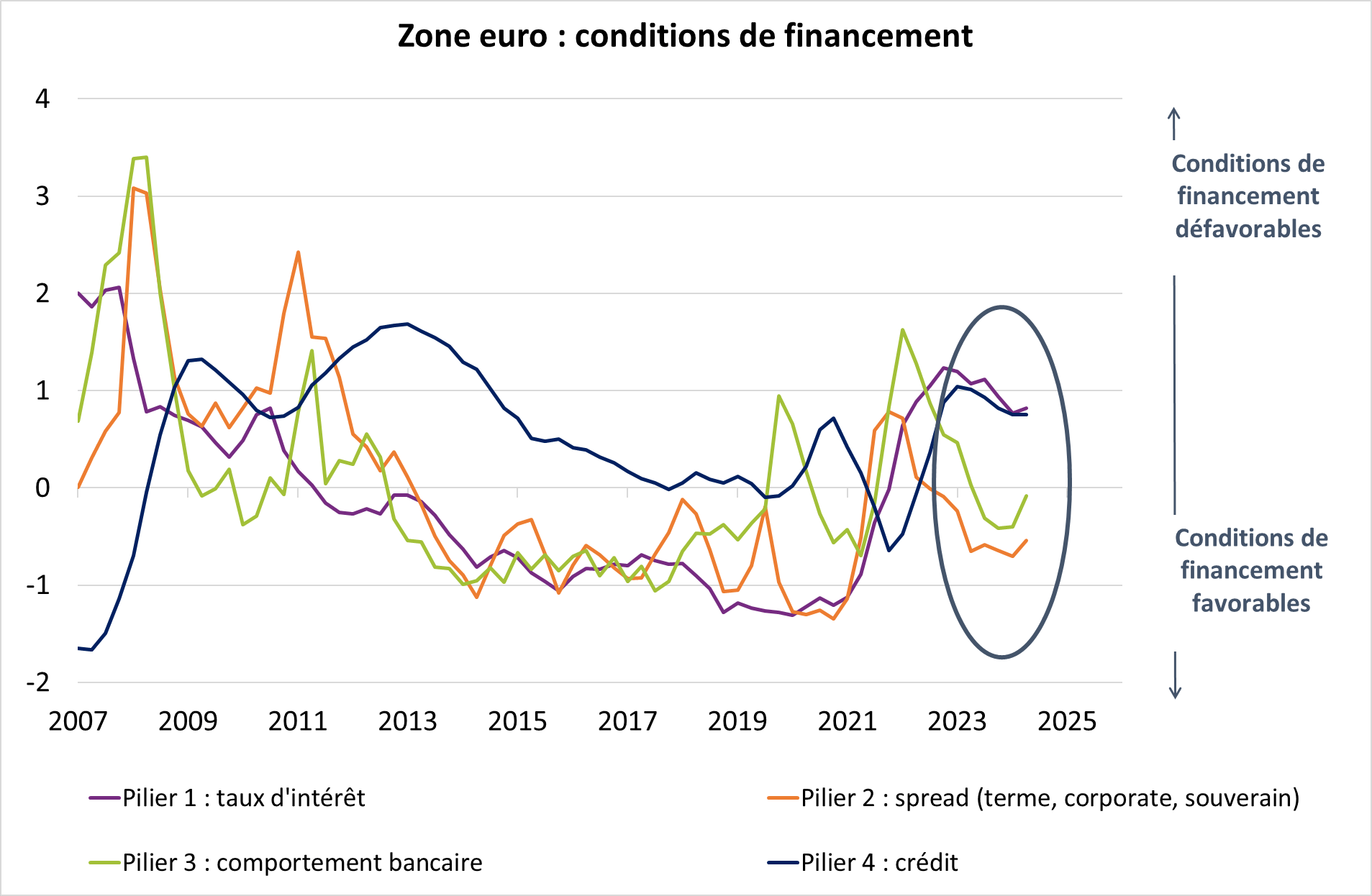

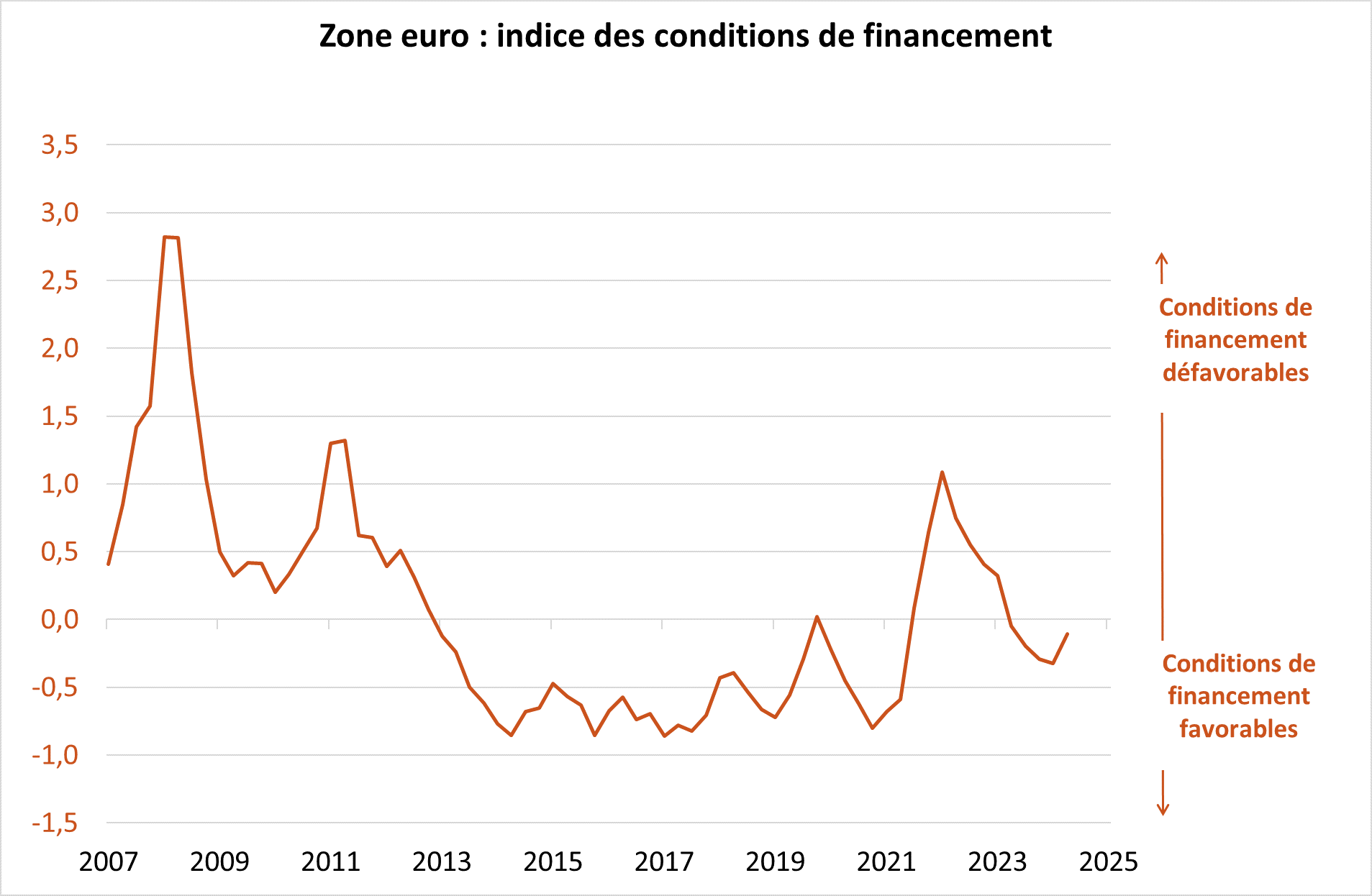

Overall, the results of the January survey indicate that the recent easing of monetary policy has not yet been fully reflected in banking conditions (see Graphs 3 & 4): economic and political uncertainty continues to affect banks' willingness to lend, and demand remains lackluster. These results thus reflect banks' cautious approach and will undoubtedly be discussed by the ECB at the next Monetary Policy Council meeting (Thursday). As a reminder, the ECB is very likely to further reduce the restrictive stance of its monetary policy by 25 basis points, bringing the deposit rate to 2.75%.

(*) ECB survey conducted between December 10, 2024, and January 7, 2025 (155 banks surveyed, with a 99% response rate).

DISCLAIMER

This document is intended for informational purposes only.

Groupama Asset Management and its subsidiaries disclaim any liability in the event of alteration, distortion, or falsification of this document. Any unauthorized modification, use, or distribution, in whole or in part, in any form whatsoever is prohibited.

Before making any investment, investors must review the prospectus or the Key Investor Information Document (KIID) of the UCITS. These documents, along with other periodic reports, are available free of charge upon request from Groupama AM or at www.groupama-am.com.

This non-contractual document does not constitute a recommendation, a solicitation, or an offer to buy, sell, or trade, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized recommendations.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com