Unsurprisingly, the ECB kept monetary conditions unchanged (deposit facility rate at 2%). The press conference had a rather “hawkish” tone in four respects:

C. Lagarde acknowledged the “cyclical resilience.” Beyond the exceptional effects related to Ireland and global trade, first-quarter GDP growth was supported by private demand (consumption and investment).

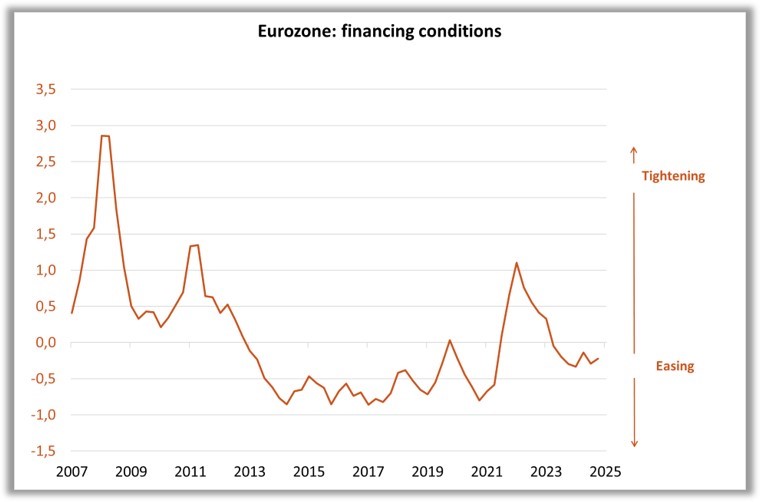

Financing conditions are more accommodative, which is also confirmed by our own indicator (see chart).

The balance of risks to growth remains tilted to the downside, mainly due to uncertainties surrounding the trade war. However, C. Lagarde clearly pointed out that if trade negotiations between the United States and Europe were to conclude quickly, it could significantly reduce uncertainty and restore confidence among economic decision-makers.

Finally, the statement clarified the ECB’s reaction function. Thus, monetary policy would depend not only on the inflation outlook but also on the balance of risks surrounding the central scenario. C. Lagarde strongly emphasized that an increase in tariffs would likely at some point lead to bottlenecks and tensions in supply chains, which would feed into inflation.

In conclusion, the “bar is now higher” for the ECB to ease its monetary stance. The final 25 bps rate cut that we have penciled in for this year is no longer a given. It now seems very unlikely in September. However, our economic scenario still anticipates a continued depreciation of the dollar and, consequently, an appreciation of the euro. This movement in the exchange rate would reduce imported inflation, allowing us to maintain the target of 1.75% for the deposit facility rate.

Source: Bloomberg – Calculations: Groupama AM

DISCLAIMER

This document is intended exclusively for informational purposes.

Groupama Asset Management and its subsidiaries disclaim all liability in the event of any alteration, distortion, or falsification of this document. Any unauthorized modification, use, or distribution, in whole or in part, in any form whatsoever, is prohibited.

Before making any investment, investors must read the prospectus or the Key Information Document (KID) of the fund. These documents, along with other periodic reports, are available free of charge upon request from Groupama AM or at www.groupama-am.com.

This non-contractual material does not constitute, under any circumstances, a recommendation, a solicitation, or an offer to buy, sell, or arbitrate, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized investment advice.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com