To calibrate monetary policy, central bankers need to determine the degree of restrictiveness/accommodation in monetary conditions. To do this, they often refer to the concept of the “natural interest rate” (called r, “r-star”). This is the interest rate that allows inflation to stay at the 2% target while ensuring full employment. It is a “neutral,” “equilibrium,” or “optimal” interest rate.

Recently, the debate around this concept has intensified because this interest rate is supposed to be the future target for the policy rates, the "target value." At the last press conference following the monetary policy committee meeting, C. Lagarde mentioned an update to a research paper by ECB economists, evaluating the current level of this neutral interest rate (Natural rate estimates for the euro area: insights, uncertainties and shortcomings (europa.eu)). According to the models and estimation ranges, the neutral policy rate in the Eurozone is currently between 1.75% and 2.25%. However, ECB economists emphasize the very limited operational value of their estimates. This caution aligns with our own conclusions when we conducted similar work with Financial Engineering, replicating the work of Laubach & Williams on the U.S. case:

- The results are statistically not robust because they are highly sensitive to specifications and assumptions, particularly the assessment of potential growth.

- The estimates are based on past observations. Past shocks can significantly skew results, making them less relevant for assessing the current situation, especially in times of regime change.

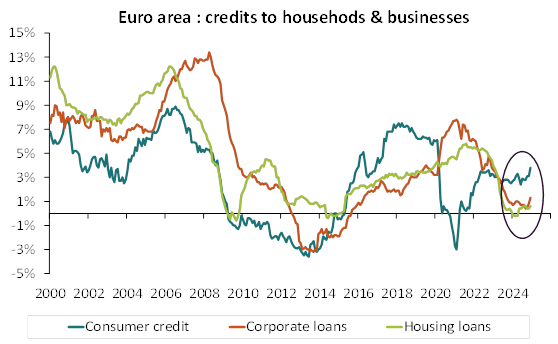

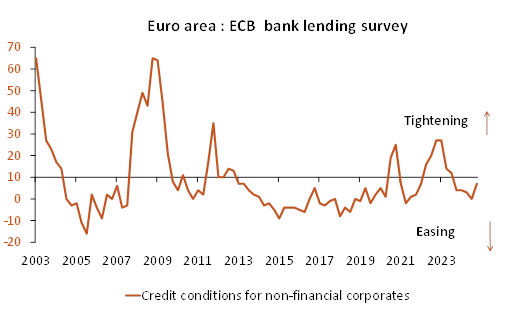

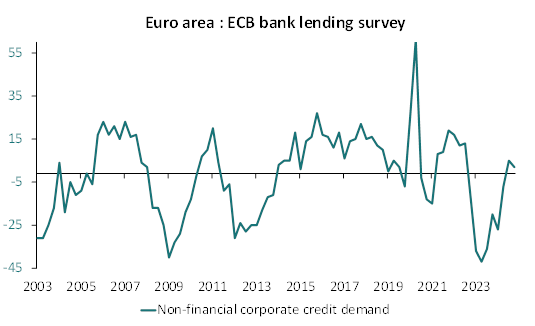

Therefore, central bankers cannot rely on these estimates for their monetary policy decisions, as mentioned recently by several members of the ECB's Governing Council (L. de Guindos, P. Cipollone, and P. Lane). Markets should not rely on these calculations to determine the scale of any further rate cuts. The assessment of the restrictiveness of monetary policy can only be based on observable data, contingent on monetary policy, such as credit supply and demand data. In this regard, the revival of credit (chart 1), as well as the near normalization of credit granting conditions (chart 2) and credit demand (chart 3), suggest that monetary policy in the Eurozone may not be far from "neutrality."

We still believe that our constructive growth scenario is consistent with a regime of inflation and policy rates higher than those anticipated by the consensus and financial markets. We maintain our target for the ECB deposit rate at 2.50%.

Source : BCE et Bloomberg – Calculs : Groupama AM