3. J. Powell’s main message is that uncertainty is extremely high, and it is urgent to wait and gain more visibility before adjusting monetary policy. But what exactly is the Fed waiting for? Powell clearly downplayed the importance of surveys (soft data), which have recently been too pessimistic compared to actual conditions. The Fed will adjust its monetary policy only in response to real data (hard data). Based on Powell’s comments during the press conference, we believe the key indicators the Fed will give extra weight to in the coming weeks are:

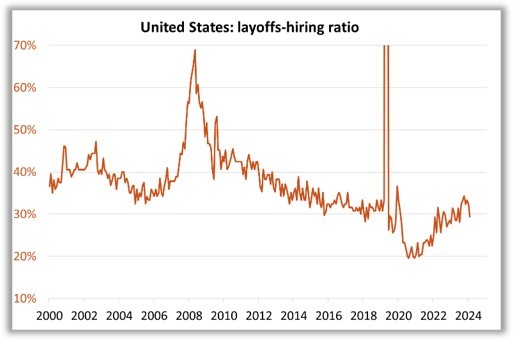

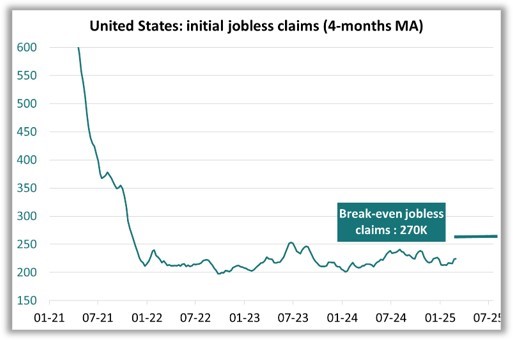

a. On employment, the balance between layoffs and hires in the JOLT Report (Chart 4), with a particular focus on the layoff rate, since an increase could "quickly translate into a rise in the unemployment rate." The Fed will also pay close attention to the monthly Employment Reports and weekly jobless claims. We estimate the threshold for job creation/destruction to be around 270K (Chart 5).

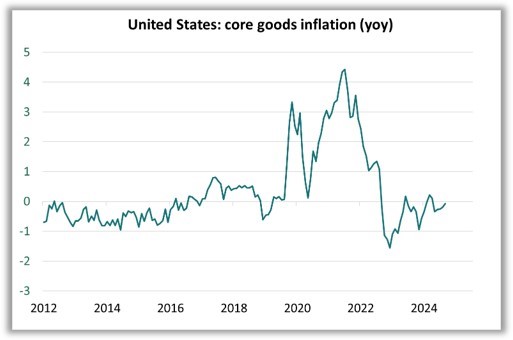

b. On inflation, the most relevant data point is the evolution of goods prices, which is expected to reflect the impact of the recent tariff hikes (Chart 6).

Source : Bloomberg – Calculations : Groupama AM

4. In conclusion, the Fed’s emphasis on employment data and its willingness to once again describe inflation as "transitory" reflects its bias in favor of the growth argument. The weekly jobless claims, JOLT, and Employment Reports will be key market movers. Our updated growth and inflation forecasts will be published next week and will reflect the "air pocket" we’ve identified in U.S. growth. The question is not whether rates will be cut, but how much. By announcing that its balance sheet is nearing target size, the Fed is signaling its readiness to reactivate the tool of quantitative easing in the event of a sharp equity market downturn.