The release of the FOMC Minutes from the mid-December meeting provides some interesting insights:

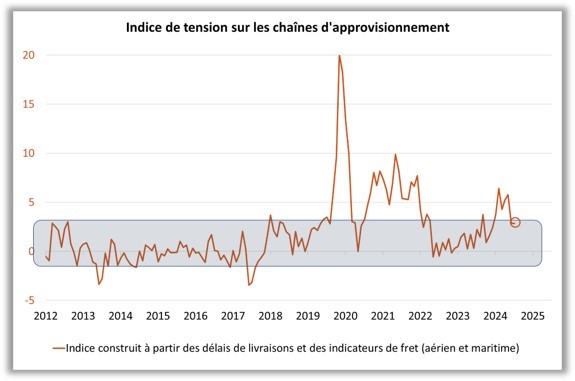

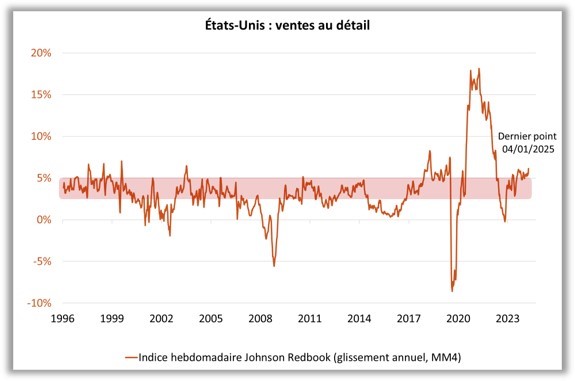

- Central bankers acknowledge that bringing inflation back to the 2% target will take longer than expected due to the latest figures, which came in higher than anticipated. Moreover, upside risks to inflation have increased, particularly with potential tariff hikes and immigration measures. Additionally, the Fed highlights the geopolitical environment, which could still cause disruptions in supply chains (Chart 1 shows that these tensions have not fully normalized), and consumption, which could strengthen further (Chart 2 illustrates an acceleration in weekly sales at the turn of the year).

- The central bankers’ business contacts are more optimistic due to expectations of deregulation and tax cuts. While deregulation seems assured, we infer that business confidence could reverse if tariff hikes are not accompanied by corporate tax reductions.

- Uncertainties have increased, particularly in the labor market, where they are now considered "significant." More broadly, rising uncertainties justify a more cautious approach to monetary policy.

- The Fed mentions the rise in financial instability due to the "overvaluation of risky assets." The term "overvaluation" is explicitly stated, and we believe this argument now supports keeping interest rates higher for longer.

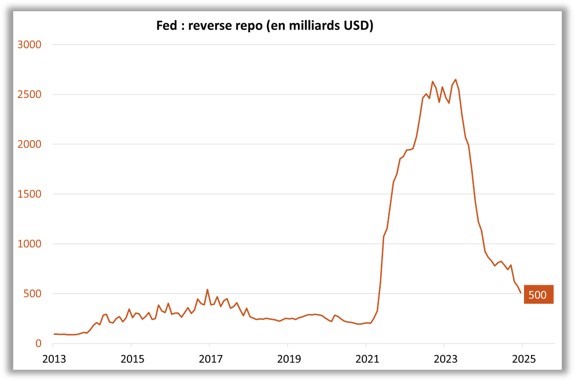

Balance sheet management was not discussed. The recent acceleration in the decline of reverse repos (Chart 3) leads us to anticipate an earlier end to balance sheet reduction—potentially by early summer instead of year-end.

Source : Bloomberg – Calculs : Groupama AM

DISCLAIMER

This document is intended for informational purposes only.

Groupama Asset Management and its subsidiaries disclaim any liability in the event of alteration, distortion, or falsification of this document. Any unauthorized modification, use, or distribution, in whole or in part, in any form whatsoever is prohibited.

Before making any investment, investors must review the prospectus or the Key Investor Information Document (KIID) of the UCITS. These documents, along with other periodic reports, are available free of charge upon request from Groupama AM or at www.groupama-am.com.

This non-contractual document does not constitute a recommendation, a solicitation, or an offer to buy, sell, or trade, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized recommendations.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com