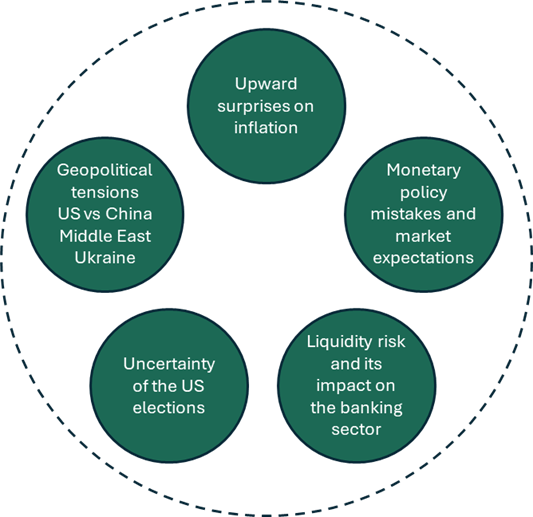

The multiplication of sources of tension in 2024

Volatility is currently at historic lows. However, we see several risks that could lead to spikes in volatility this coming year.

- There are a number of ways in which investors can protect themselves against uncertainty: remaining invested in money market instruments, setting up temporary hedges, or investing in funds that do not make directional bets.

- Non-directional does not mean no performance.

- LGAFI's range of non-directional absolute return funds aims to deliver performance while generating alpha by exploiting market inefficiencies.

- The spikes in volatility that we expect to see this year are sources of opportunities that we will be trying to capture through our arbitrage strategies.

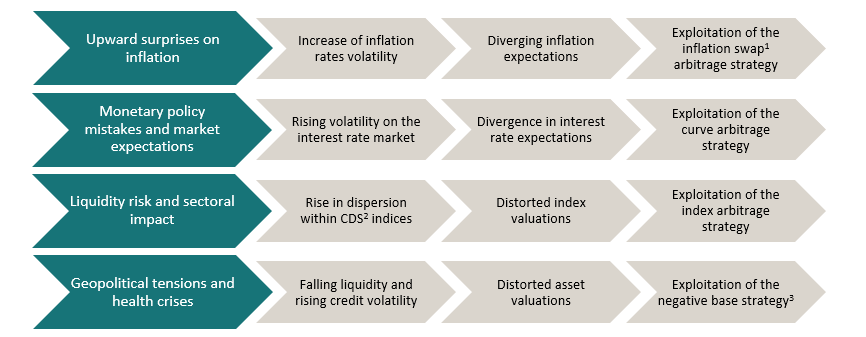

The emergence and identification of inefficiencies

Each type of risk leads to market conditions that might be favourable to the emergence of specific, sometimes predictable, inefficiencies, making it possible to implement arbitrage strategies at the right time. As an example, we can identify opportunities related to these types of risk.

1 Swap: exchange of flows at a given horizon.

2 CDS: Credit Default Swap – Credit risk hedging product.

3 Negative base: Purchase of a bond and its CDS with interest-rate risk hedging

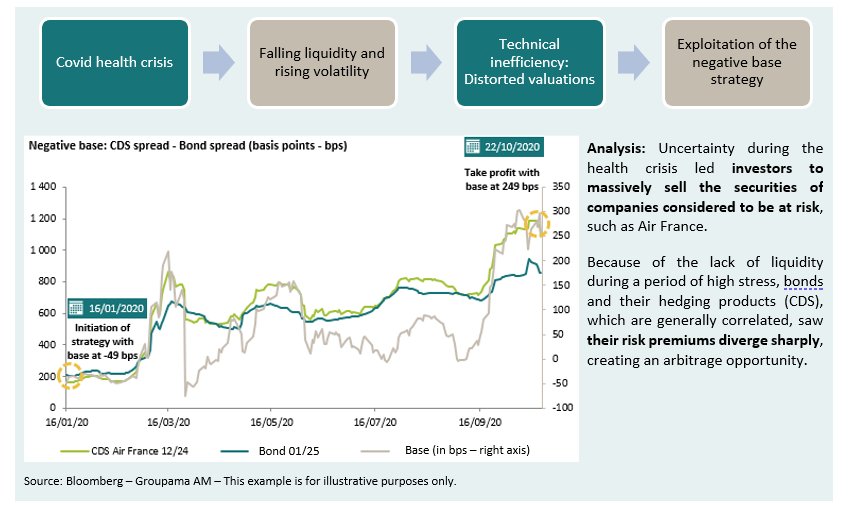

Example of a negative base strategy implemented on Air France

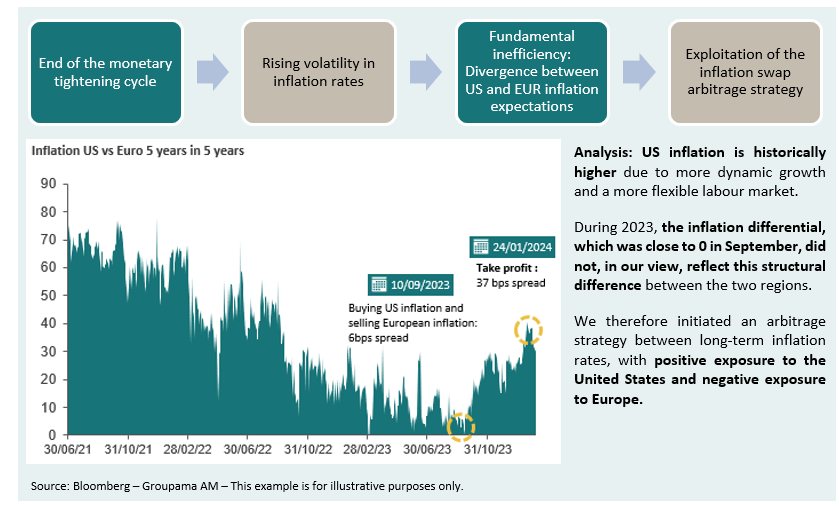

Example of an arbitrage strategy between US and European inflation rates

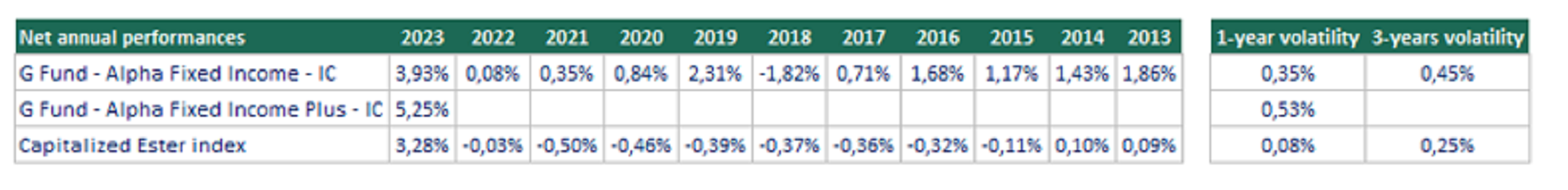

Performance and volatility of GAFI and GAFI Plus

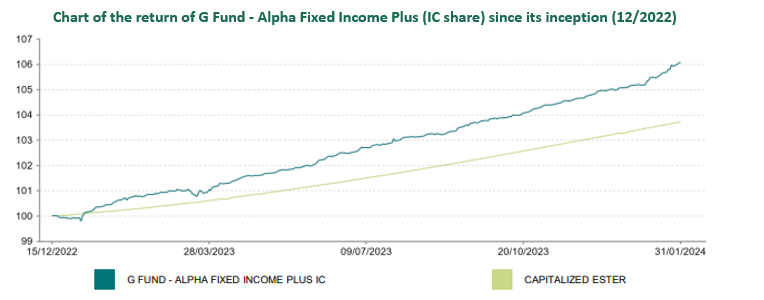

Chart of the return of G Fund - Alpha Fixed Income Plus (IC share) since its inception (12/2022)

Source : Groupama AM

Past performance does not predict future returns and may vary over time. Performances shown relate to the IC share, which is reserved for institutional investors.

Document written on 08/02/2024.

Main risks

Capital risk, Interest rate risk, Credit risk, Liquidity risk, Risk linked to investments in derivative products.

Please refer to the prospectus for a complete list of risks.

Disclaimer

This is a marketing communication. Please refer to the prospectus/key investor information document before making any final investment decisions.

Investing in this product involves risks. Every investor must be informed, before making any investment, by reading the prospectus and the key investor information document (KID) of the investment fund. These documents, which provide detailed information about risks and fees, as well as other periodic documents, can be obtained free of charge upon request from Groupama AM or at www.groupama-am.com.

Groupama Asset Management declines any responsibility in case of alteration, deformation or falsification of this document. This document is intended solely for the use of its recipients. Any modification, use or distribution, in whole or in part, is forbidden. Groupama Asset Management shall not be held liable for any use that may be made of the document by a third party without its previous written authorisation.

Past performance does not predict future returns and may vary over time.

The investment poses a risk of capital loss.

The information regarding sustainability is available here.

The information contained in this publication is based on sources that we consider reliable, but we do not guarantee that it is accurate, complete, valid, or timely.

This document has been established on the basis of data, forecasts and hypothesis which are subjective. The analysis and conclusions lead to express an opinion, at a specific date, and based on a methodology proprietary to Groupama AM.

Considering the subjective and indicative nature of these analysis, they shall not be construed in any way whatsoever as an undertaking or guarantee on the part of Groupama Asset Management or a personalised recommendation.

This non-contractual document does neither constitute a recommendation nor a solicitation, nor an offer to buy, sell or arbitrate, and should not be interpreted as such.

This document provides you with key investor information about the sub-fund of G Fund (the SICAV), collective investment fund ("OPC") incorporated in Luxembourg, relating to the part I of the Law of 20 December 2002 and incorporated as an Investment Company with variable capital. The SICAV is registered with the Registry of Commerce and the Companies of Luxembourg, under the number B157527 and its headquarter at 5, allée Scheffer, L-2520 Luxembourg. The marketing of G FUND was authorised by Commission de Surveillance du Secteur Financier of Luxembourg.

Subscribers are advised that not all sub-funds of SICAV are registered or authorised for sale or available to all investors, in all jurisdictions.

These documents may be obtained free of charge at the SICAV's registered office or respectively at that of the representative agent duly authorised and agreed by the relevant authority of each relevant concerned jurisdiction.

The sales teams of Groupama Asset Management and its branches remain available to provide you with personalised service.

Published by Groupama Asset Management, - Registered office: 25 rue de la ville l'Evêque, 75008 Paris - Website: www.groupama-am.co