G Fund - Alpha Fixed Income Plus (GAFI+) is collecting new funds quickly!

In just 3 months, the fund's assets under management have grown to almost €300m, i.e. more than €1 billion for the non-directional absolute return strategy Alpha Fixed Income.

This momentum confirms the success of this strategy, which makes perfect sense in the current environment:

- By maintaining its performance objective of Ester + 2.5% net1 , i.e. 6.4%2 net overall under current conditions, thus providing a core portfolio solution that is competitive with money market or short-term bond funds despite the current fall in risk premiums and therefore bond market yields.

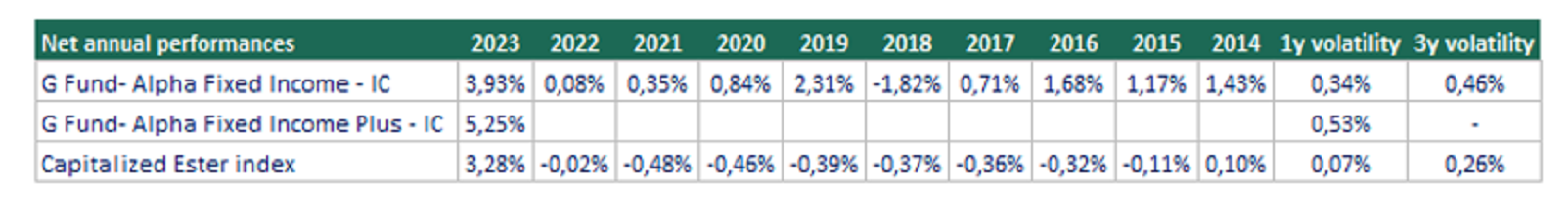

- By adopting a market-neutral approach with limited directionality, the fund is protected from current and future volatility (adjustment of expectations of interest rate cuts, inflation resilience, geopolitical risks, election year, etc.) by hedging its exposure to credit and interest rate risks. The fund's volatility is therefore contained (1-year volatility of 0.53% at 29/02/2024).

- By exploiting technical and fundamental market inefficiencies through arbitrage strategies.

This approach, already implemented by the G Fund - Alpha Fixed Income fund (GAFI), has proved its value, with 80% of arbitrage operations delivering positive returns over the last three years3.

Overview of our absolute return strategy Alpha Fixed Income

The strategy of GAFI and GAFI+ is based on the management of two distinct pockets:

• A core pocket made up of bonds, mainly of good credit quality, with short maturities, to optimise the risk/return profile and guarantee the portfolio's liquidity.

• An alpha pocket aiming to deliver absolute performance through arbitrage strategies on the fixed income and equity markets (via index), by detecting and exploiting technical and fundamental inefficiencies on the markets.

Objectives of G Fund -Alpha Fixed Income Plus

The G Fund - Alpha Fixed Income Plus adopts a similar management philosophy but is distinguished by a more dynamic approach. The fund aims to meet the following objectives: risk management of maximum capital loss, diversification of performance drivers and optimisation of investment liquidity.

With the launch of this fund, Groupama AM is expanding its range of short-term solutions, to provide an alternative to money market funds and offer a higher expected return (ESTER +2.5% gross over a rolling year within a risk budget expressed by the VaR4 ).

Strategy performance drivers

To achieve these objectives, the management team has a number of levers at its disposal, including:

• Optimising the management of the fund's core portfolio.

• Greater diversification of alpha strategies, including:

- Strategies involving long and short positions on two highly correlated assets.

- Negative basis strategies involving the purchase or sale of bonds and their CDS5.

- Arbitrage of issuance premiums to take advantage of dislocations in the primary market.

• Greater flexibility in managing interest rate and credit modified duration, with limited directionality on the credit component.

• Diversified investment management with no index constraints.

Investment decisions based on proven expertise

To take full advantage of market opportunities, the fund is managed using the synergies created by:

• 4 experienced co-managers in the Total Return team who interact and benefit from regular interactions with the teams specialised in the various bond asset classes (high yield, sovereign, hybrids, inflation, etc.).

• A team of analysts organised by sector with dual expertise: financial and ESG.

• The financial engineering teams and the trading desk, who provide support in detecting market inconsistencies.

Performances as at 29/02/2024:

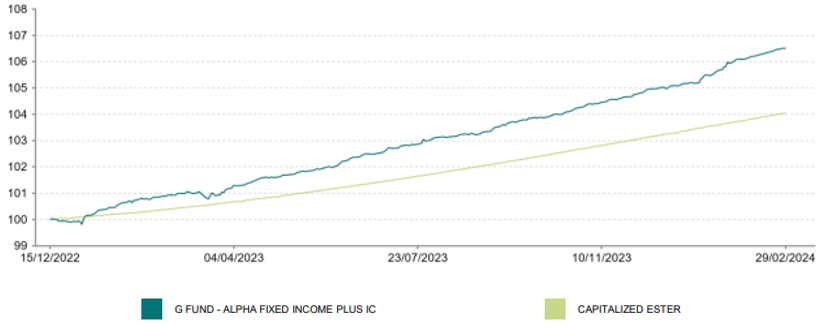

G Fund – Alpha Fixed Income Plus (IC share class): chart of performance since inception of the strategy (12/2022)

Past performance does not predict future returns and may vary over time. Performances presented are available for Institutional clients only (IC share). Performances of other share classes are available on our website.

Summary

Against a bond market that we expect to be volatile in 2024, Groupama AM has chosen to favour the implementation of a short-term absolute performance solution with very limited directionality. Whereas many players have chosen to develop vehicles that could be heavily penalised by any upward surprises in bond yields, our philosophy, which aims to generate alpha by implementing a variety of arbitrage strategies, allows us to display a more defensive profile, without jeopardising an attractive potential return.

Key benefits of the strategy

• A real alternative to traditional money market and short-term bond investment funds, in an economic and market environment that is beneficial to the strategy: market expectations of significant interest rate cuts could lead to high volatility if monetary policies are adjusted in the medium term, conditions that are conducive to the emergence of technical and fundamental inefficiencies.

• Implementation of Bottom-up conviction-based strategies, excluding directional views by systematically hedging interest rate and credit risks on the alpha pocket.

• Conviction-based, reactive and opportunistic investment management to exploit market inefficiencies in the OECD universe.

• Rigorous risk management to control volatility.

Main risks associated with the strategy

Capital risk: The Subfund offers no capital guarantee or protection. As a result, investors may not recover the full amount of their initial capital investment.

Interest rate risk: Investors’ attention is drawn to the orientation of this Subfund, the movement of which is linked to bond markets. Investments in bonds or other fixed-income securities may experience negative performance due to interest-rate fluctuations. Generally, the prices of fixed-income securities rise when interest rates fall and fall when interest rates rise.

Credit risk: The holding of bond securities may generate credit risk. This risk specifically occurs in the event of a difference in the yields of private sector bonds and government bonds, which lowers their price and will have a downward impact on the Subfund’s net asset value.

Liquidity risk: Bond markets may, from time to time, be less liquid than certain equity markets, which is likely to affect the prices at which the Subfund may be required to liquidate positions in the event of substantial redemptions.

Risk linked to investments in derivative products: The use of derivatives may result in short periods of substantial upward or downward variations in the net asset value.

Please refer to the prospectus for a full list of risks.

1 Past performance does not predict future returns and may vary over time.

2 Based on the current yield to maturity as at 20/03/2024 of 4.9%. Yields to maturity are not guaranteed and don’t prevent the investor from a capital loss.

3 Groupama Asset Management, data produced by management as part of transaction-by-transaction monitoring. Past performance does not predict future returns and may vary over time.

4 Value At Risk: maximum loss of 10% that the sub-fund may incur with a confidence interval of 99% over a 1-month horizon.

5 Credit Default Swap: derivative used to hedge against the credit risk of an issuer.