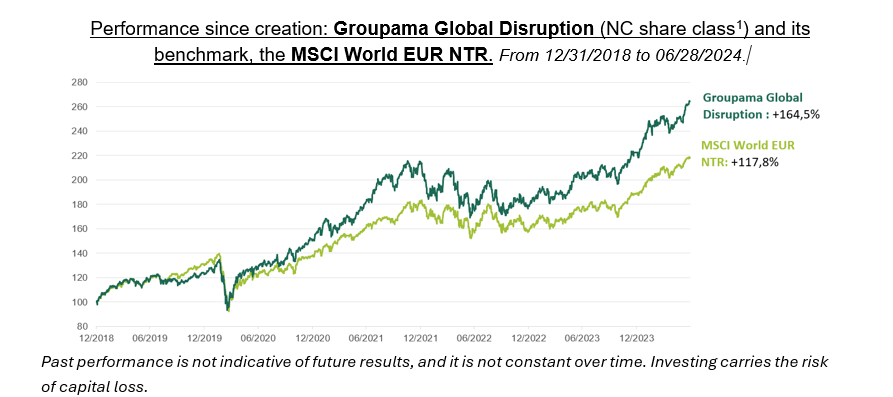

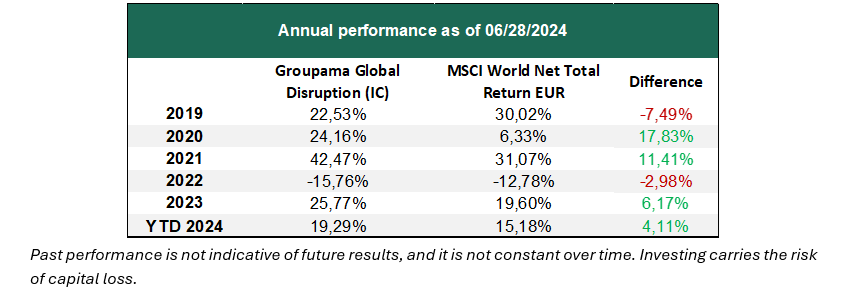

The first half of 2024 has been synonymous with positive performance for our Groupama Global Disruption fund.

The first two months of the year were very positive, thanks to our semiconductor, software, and healthcare companies. Hopes of a rate-cutting cycle from the Fed in 2024, together with excellent results from technology companies, generated strong optimism.

The fund's performance then went through a period of consolidation between March and May, as inflation fears rose, and monetary policy ultimately proved less accommodating than anticipated. In June, performance rebounded strongly, driven by our convictions in semiconductors, software, and energy, as well as by good newsflow in healthcare (notably on Alnylam).

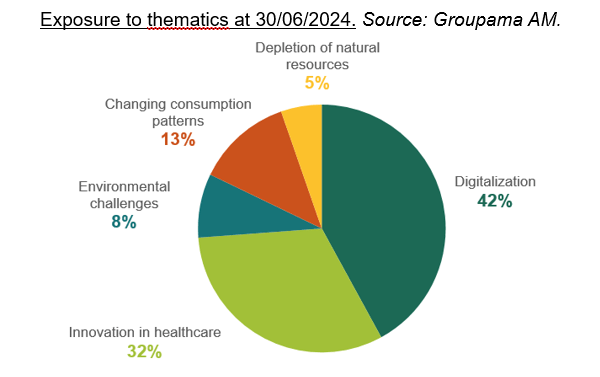

Several thematics drove performance in the first half of 2024:

- Digitization: Digitization is once again the theme of the moment, led by the great Nvidia, whose performance has exceeded a thousand percent over the last 4 years. The artificial intelligence craze has benefited several of our core beliefs either directly (Broadcom, ASML, Cadence Design, Microsoft) or indirectly linked to artificial intelligence (CyberArk Software, Palo Alto, ...), although others have also outperformed without any direct involvement with this technology, such as Motorola Solutions.

- Healthcare innovation: Stock selection was very good in the healthcare innovation theme. In biotechnology, the fund was buoyed by several companies, led by Regeneron Pharmaceuticals, whose results and outlook were hailed by investors. Robotic surgery specialist Intuitive Surgical also boosted the fund's performance, as did Denmark's Novo Nordisk, whose weight-loss products are in strong demand. At the end of June, Alnylam's share price surged following the announcement of a late-stage study for a drug in development to treat an acute form of myocarditis.

- Scarcity of natural resources: Baker Hughes, whose inventions have revolutionized the energy sector, rebounded in June as oil prices recovered and investors gained confidence in the energy technology company.

Main YTD movements and positioning at 06/30/2024.

At the start of the year, we introduced exposure to AMD, a US manufacturer of semiconductors, microprocessors, and graphics cards, which we believe could increasingly gain market share in artificial intelligence and disrupt Nvidia's dominance.

In healthcare, we opened several new positions, including Boston Scientific (innovative medical technologies), Legend Biotech (biotechnology) and Shockwave Medical (acquired shortly afterwards by Johnson & Johnson).

We also introduced XPO, a leader in less-than-truckload logistics.

We sold several shares and made a few investments in digitalization to strengthen other existing lines in healthcare innovation and resources, and to initiate the values mentioned above.

Outlook

Although investor enthusiasm for AI is at an all-time high, we remain confident about its long-term potential. This technology is spreading across many sectors, attracting a large number of players eager to capitalize on it. Inevitably, there will be winners and losers in this revolution. That's why we'll be particularly vigilant about the sustainability of business models in this field.

In the megatrend of healthcare innovation, we expect many more disruptive transformations to follow (similar to what Novo Nordisk did with Wegovy in 2023) in chronic disease areas where recent new treatments have been brought to market, often for the first time.

Finally, climate change and resource scarcity represent pressing challenges for our planet. Between green energies, sustainable mobility and water management, several industries offer excellent prospects for the best-positioned companies.

In 2024, our commitment to identifying and supporting disruptive companies remains firm. True to our investment philosophy, we will continue to capitalize on the most innovative players who, driven by megatrends, are experiencing an acceleration.

The main risks are:

- Equity risk: Changes in share prices may have a positive or negative impact on the net asset value of the fund.

- Risk of capital loss: There is a possibility that the capital invested may not be returned in full.

- Liquidity risk: Linked to exposure to small- and mid-cap stocks, whose free float may be limited.

- Small and mid-cap market risk: On small and mid-cap markets, the volume of securities listed on the stock market is reduced, so market movements are more pronounced on the downside, and faster than in the case of large caps.

DISCLAIMER

This document is designed for information purposes only. Groupama Asset Management declines all responsibility for any alteration, distortion, or falsification to which this document may be subjected. The information contained in this document is confidential and reserved for the exclusive use of its recipients. Any unauthorized modification, use or distribution, in whole or in part, in any manner whatsoever, is prohibited. Past performance is no guarantee of future performance.

The information contained in this publication is based on sources that we consider reliable, but we do not guarantee that it is accurate, complete, valid, or timely. This document has been prepared based on information, projections, estimates, expectations, and assumptions that involve a degree of subjective judgement. The analyses and conclusions are the expression of an independent opinion, formed from public information available on a given date and following the application of a methodology specific to Groupama AM. Given the subjective and indicative nature of these analyses, they do not constitute any commitment or guarantee by Groupama AM or personalized investment advice.

This non-contractual document in no way constitutes a recommendation, a solicitation of an offer, or an offer to buy, sell or arbitrage, and must not be interpreted as such under any circumstances. The sales teams of Groupama Asset Management and its branches are at your disposal to provide you with a personalized service.

Published by Groupama Asset Management, management company approved by the AMF under number GP 93-002 - Registered office: 25 rue de la ville l'Evêque, 75008 Paris - Website: www.groupama-am.co: https://www.groupama-am.com/