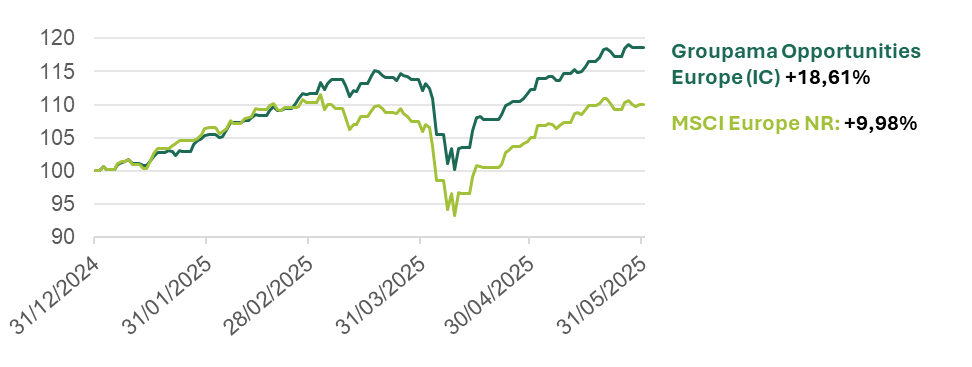

Since the beginning of the year, fears about world trade and the rise in geopolitical tensions have had a profound influence on the European equity markets. Against this volatile backdrop, Groupama Opportunities Europe was able to take advantage of its sector choices and the quality of its stock selection to generate a 2025 performance of +18.61% as at 31/05 (compared with +9.98% for its index, the MSCI Europe NR).

Chart 1. 2025 performance of the fund and its index.

From 31/12/2024 to 31/05/2025. Source : Groupama AM.

Past performance is no guarantee of future performance and is not constant over time. There is a risk of capital loss.

Stock selection was the main driver of outperformance, thanks in particular to :

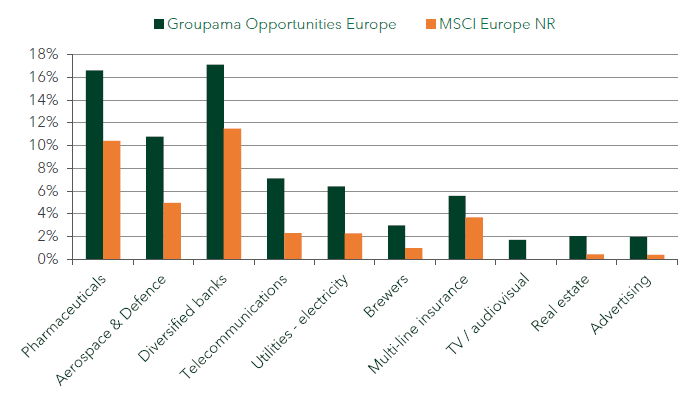

1) Our recent investments in two defence stocks: Thales1 , initiated in 2024, and Rheinmetall, initiated in February 2025, a few weeks before the announcement of the vast German investment plan, of which 200 billion would be allocated to defence. In February, we felt that Rheinmetall's valuation over the 2030 horizon was particularly attractive, with a price/earnings ratio2 estimated at just 4/6 times - a level that fully justified entry into the fund. We believe that the long-term prospects for this sector remain very solid, even assuming that the conflict in Ukraine comes to an end soon.

2) The quality of our stock selection in the banking sector: our positions in Société Générale, Alpha Services, BCP, CaixaBank and Banco Santander made a significant contribution to the fund's outperformance. We have partially reduced our overexposure to banks, but we intend to maintain it (mainly on southern European banks). We remain positioned in two French banks: BNP and Société Générale, which has recently shown that it has the potential to continue its growth trajectory.

3) The very good performance of our defensive stocks, which now account for half of the fund's exposure. Numerous defensive positions such as AB-Inbev (global brewer), Orange and Deutsche Telekom (telecoms), Axa and Generali (insurance), and Iberdrola (energy supplier) are all examples of stocks that have delivered solid performances since the start of the year, despite the fact that the overall theme has not been buoyant.

4) A number of stocks are absent from the fund and down in the index: ASML, Novo Nordisk, LVMH and Schneider Electric are the main examples.

Conversely, exposure to companies facing short-term headwinds but with strong upside potential, such as Air-France, Remy Cointreau, Anglo American and Publicis, was a drag on relative performance.

Positioning and recent movements

Today, 50% of the portfolio remains invested in defensive stocks, while exposure to cyclical stocks remains very limited. Finally, although reduced, exposure to the banking sector has been maintained, notably via French and Southern European banks.

In terms of movements, the fund has significantly reduced its oil exposure (from 11% to 5% in 5 months), with recent sales of Saipem and Repsol and reductions in Total, BP and Eni.

As explained above, the portfolio has recently included the defence sector, which now represents 4.7% of the portfolio, via Thales and Rheimetall. More broadly, Aerospace & Defence represents 10.8% of the fund's exposure.

[1] These examples are provided for illustrative purposes only. This information does not constitute, in whole or in part, an investment advisory service, an offer or a personalised recommendation for the investment

[2] Price/earnings ratio: an indicator used to assess the value of a company.

Chart 2. Top 10 overexposures (by industry)

Outlook

Outlook

In a European context marked by macroeconomic stabilisation, attractive valuations and a geopolitical redefinition of trade and currency flows, we believe that European equities offer a number of advantages for portfolio allocations. Investors looking for visibility, diversification and potential for revaluation now have solid reasons to reposition themselves in this region.

Indeed, a number of macroeconomic, political and microeconomic signals are converging to position Europe as an attractive territory for long-term investors:

- Economic recovery supported by two major plans: NextGenerationEU (€806bn) and Readiness 2030, targeting defence, infrastructure, energy, digital technology and health.

- Bank and market financing conditions have returned to favour3 : the monetary tightening seen since 2022 has been partially digested by businesses.

- A more favourable dynamic in Europe than in the United States: a stable institutional framework, budgetary discipline, external surpluses, credibility of the ECB.

- An overvalued dollar (estimated to be ~20% overvalued) and an explicit desire on the part of the United States to cause the dollar to fall, which would make European assets relatively more attractive.

- US protectionism: the European Union could seize the opportunity to accelerate the diversification of its trade flows towards other regions.

- Historical valuation discount: MSCI Europe PE ≈ 15x vs ≈ 22x for the S&P 500, i.e. a discount of over 30% despite comparable earnings momentum.

- European indices that are more diversified (no "Magnificent 7"-style hyper-concentration), less exposed to valuation excesses and better suited to a defensive approach.

- Best-ever resilience during periods of market stress, thanks to the presence of value stocks and defensive sectors.

(Click on the fund name to find out more)

Groupama Opportunities Europe: opportunistic management, with a strong bias towards European equities.

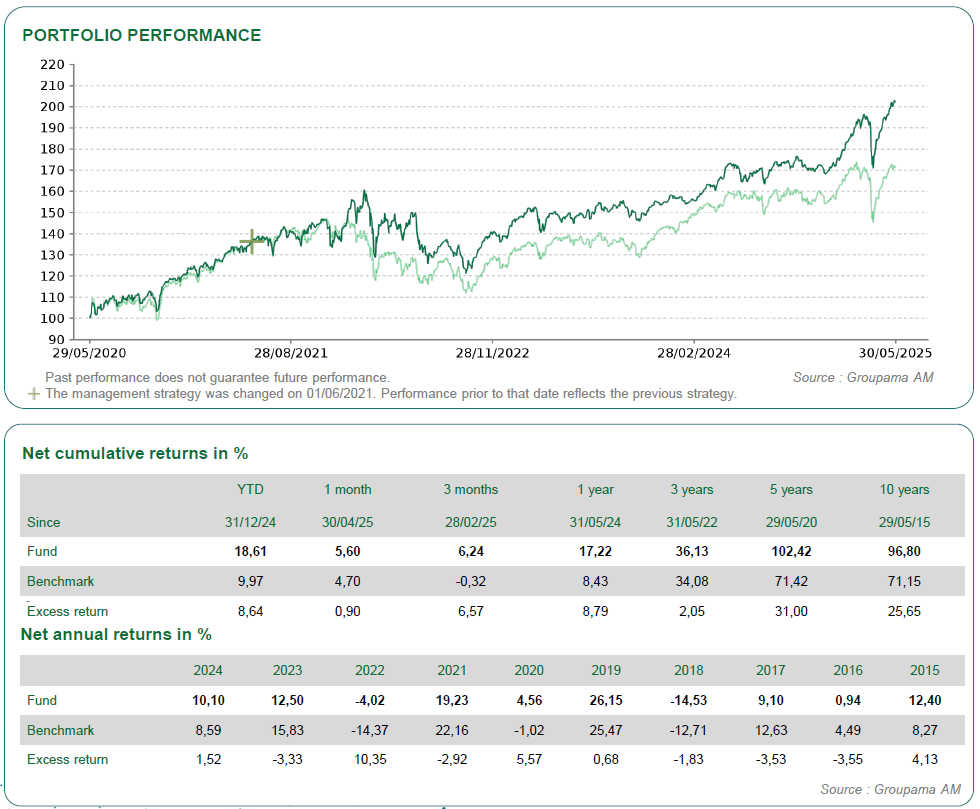

Performance Groupama Opportunities Europe, Part IC, 31/05/2025

The main indicators and risks of Groupama Opportunities Europe are :

Risk indicator: 5/74

Recommended investment period: > 5 years

-

Equity risk : Changes in share prices may have a positive or negative impact on the net asset value of the fund.

-

Risk of capital loss: The capital invested may not be returned in full.

-

Liquidity risk: Linked to exposure to small- and mid-cap stocks, whose free float may be limited.

Disclaimer

This is an advertising communication.

This investment involves risks. Before investing, investors should read the prospectus and the key investor information document (KID) of the UCI. These documents, detailing all information on risks and costs, as well as other periodic documents, can be obtained free of charge on request from Groupama AM or at www.groupama-am.com.

Groupama Asset Management declines all responsibility in the event of alteration, deformation or falsification of this document. This document is intended solely for the addressees. Any unauthorised modification, use or distribution, in whole or in part, is prohibited. Groupama Asset Management shall not be liable for the use of this document by a third party without its prior written authorisation.

Past performance is no guarantee of future performance and is not constant over time. Investment carries a risk of capital loss.

The examples of securities given in this document are provided for illustrative purposes only. This information does not constitute, in whole or in part, an investment advisory service, an offer or a personalised recommendation in respect of the investment products or services presented.

Information on sustainability can be found here. https://www.groupama-am.com/fr/finance-durable/

The information contained in this publication is based on sources that we consider reliable, but we do not guarantee that it is accurate, complete, valid or timely.

This document has been prepared on the basis of projections, estimates and assumptions that involve a degree of subjective judgement. The analyses and conclusions are the expression of an independent opinion, formed from public information available on a given date and following the application of a methodology specific to Groupama AM. Given the subjective and indicative nature of these analyses, they do not constitute any commitment or guarantee by Groupama AM or personalised investment advice.

This non-contractual document in no way constitutes a recommendation, a solicitation of an offer, or an offer to buy, sell or arbitrage, and should in no way be interpreted as such. The sales teams of Groupama Asset Management and its branches are at your disposal to provide you with a personalised service.

Published by Groupama Asset Management, a management company approved by the AMF under number GP 93-002 - Registered office: 25 rue de la ville l'Evêque, 75008 Paris - Website: https://www.groupama-am.com/

[4] This indicator represents the risk profile shown in the DIC. The risk category is not guaranteed and may change during the month.