- In a world in transition, companies are forced to invest or risk not surviving beyond it. This is why the central thesis of our economic scenario is that these transitions (geopolitical, digital, etc.) will fuel a sustainable investment cycle. However, the assumption of a new investment cycle changes the perspective on the strengths and weaknesses of economies. The simultaneous restart of investment in developed countries reveals advantages and imbalances that were not apparent in the "pre-pandemic world," which was dominated by deflationary pressures.

- The main strengths and weaknesses of the U.S. and European economies act as "mirror images" of one another. The United States benefits from an ecosystem favorable to innovation, but the lack of savings makes it dependent on international capital. Conversely, the abundance of private savings in Europe is an asset, while the fragmentation of capital markets and excessive regulation hinder private initiative.

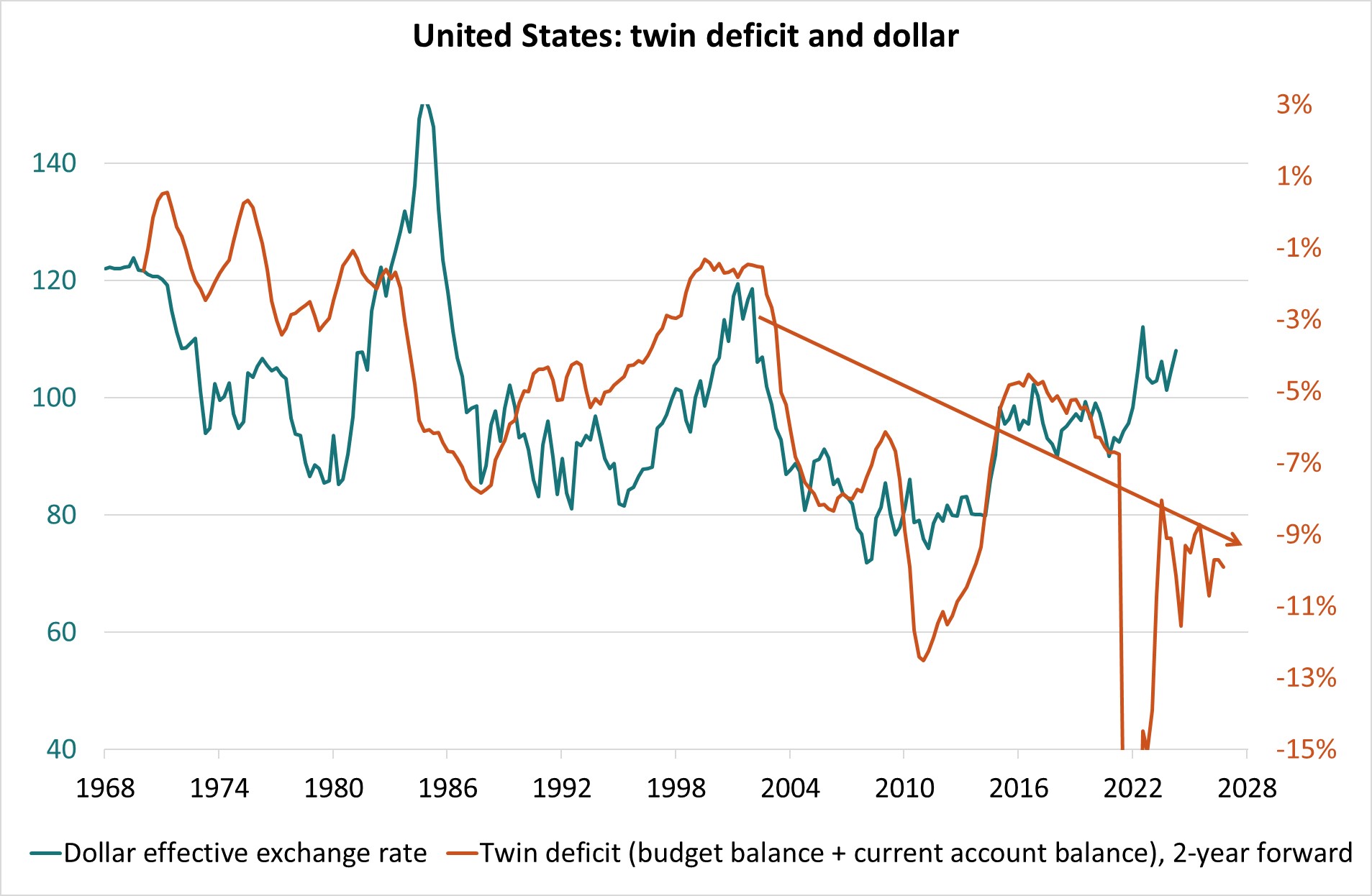

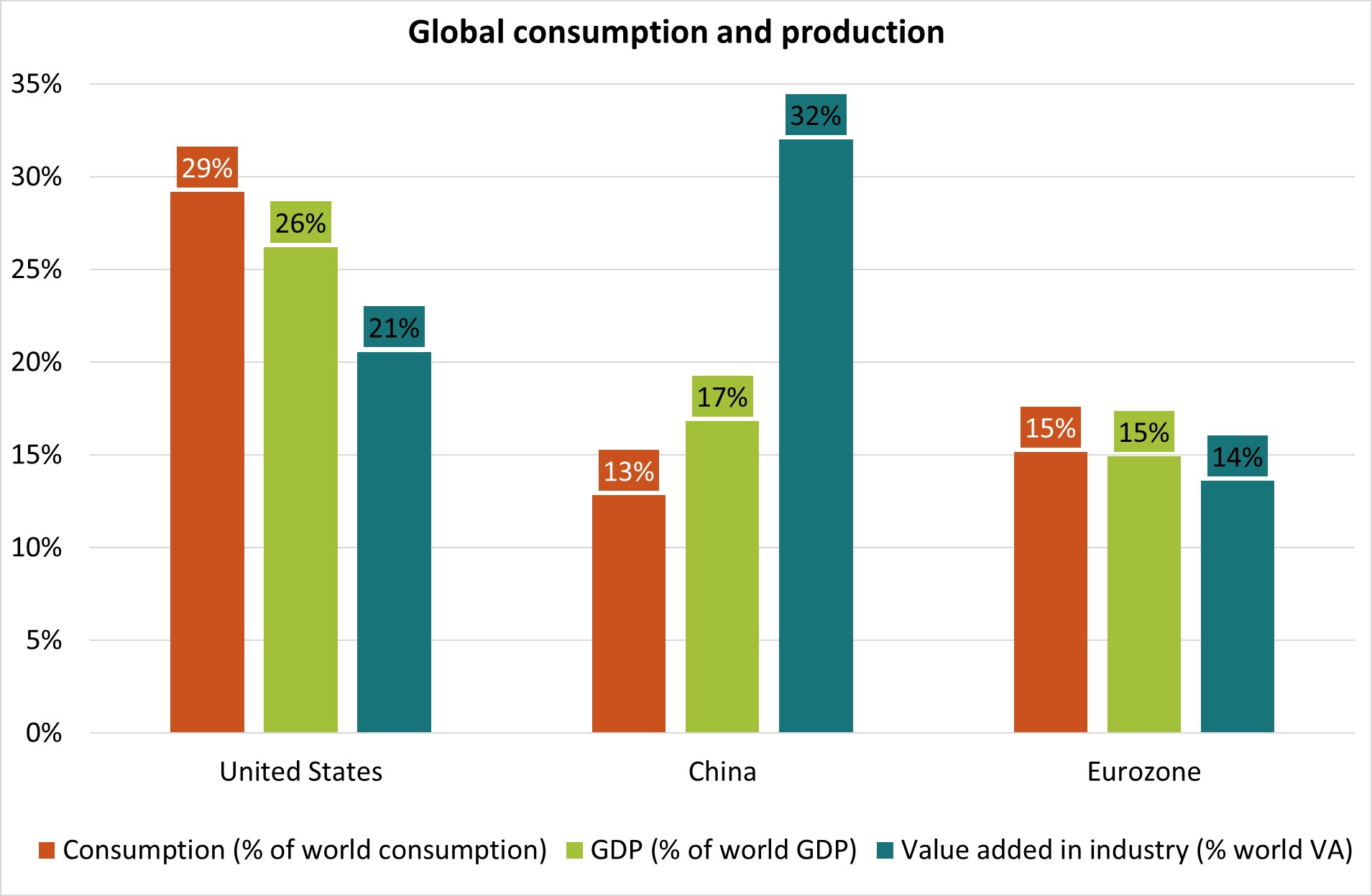

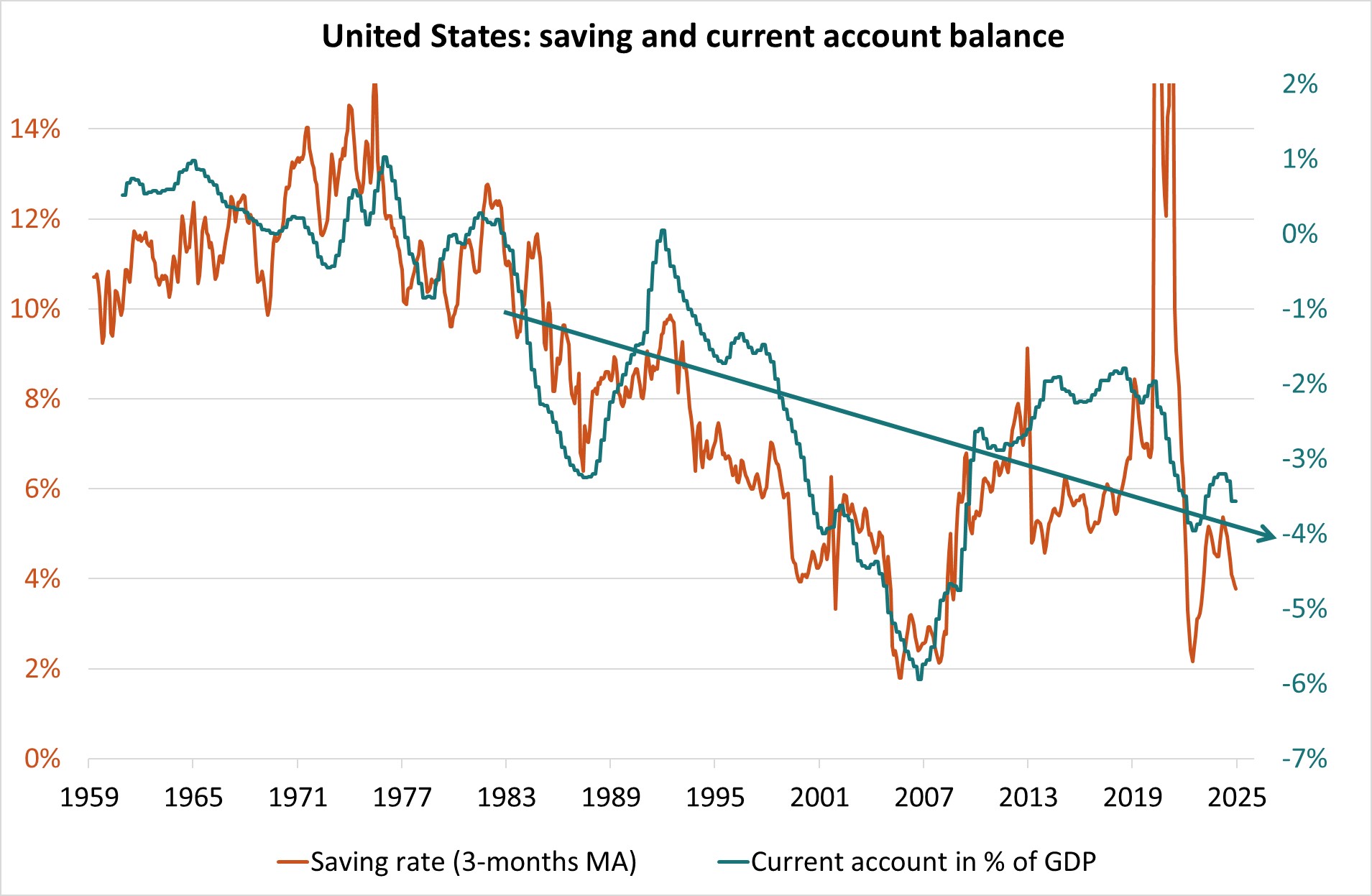

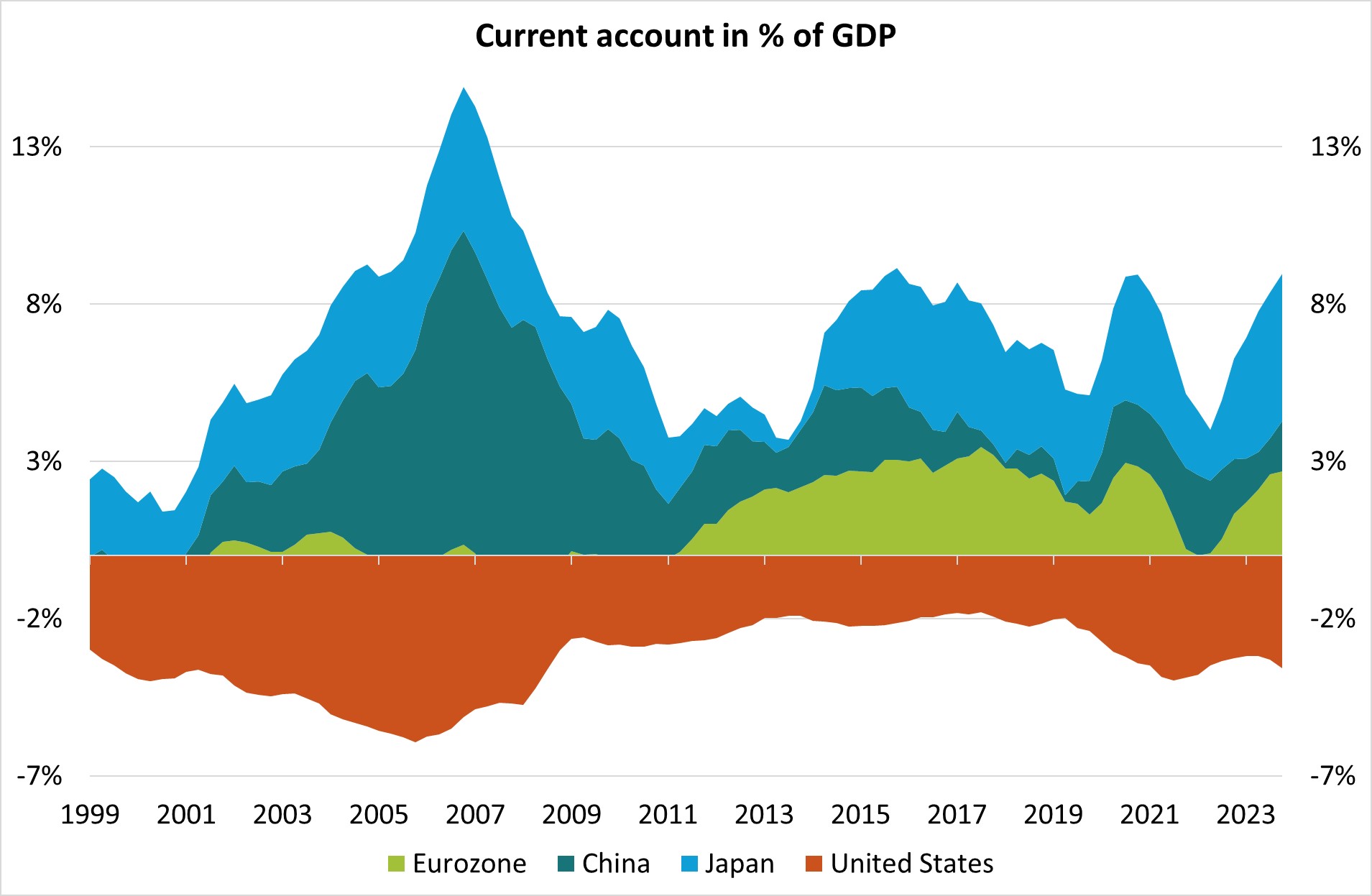

- Accounting for nearly one-third of global consumption, the U.S. economy "over-consumes" relative to its share of global production (Chart 1). This excess consumption results in insufficient savings and a current account deficit (Chart 2), in contrast to the current account surpluses of Europe, Japan, and China (Chart 3). The need to attract savings was not a problem for the U.S. in a global environment of underinvestment and abundant liquidity. However, it becomes an issue if investment restarts simultaneously across all developed countries.

Source : Bloomberg – Calculs : Groupama AM