2/ However, the BoJ is in no hurry to tighten its monetary policy further. It has "no predetermined idea" about the timing of the next rate hike and will make decisions "meeting by meeting," based on data and whether its economic forecasts materialize. What is certain is that the BoJ is still far from the neutral rate. On this point, Mr. Ueda has not changed his stance: the neutral rate remains within a broad range of 1% to 2.5%, meaning that current monetary policy is still far from the "neutral zone."

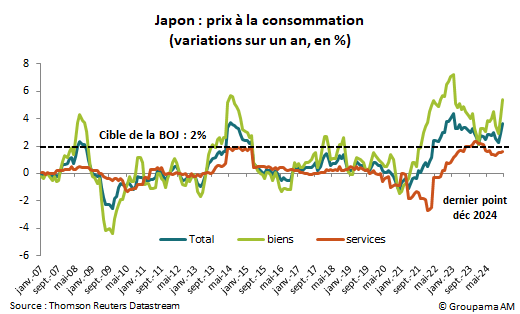

That said, the central bank is not "behind the curve," as core inflation remains moderate. Moreover, it is most appropriate to maintain a gradual, step-by-step approach because:

- 1/ The risk of Japan slipping back into long-term deflation is not zero (although this probability seems quite low); and

- 2/ The BoJ must "also observe how rate hikes affect the economy."

While the decision to raise the short-term rate was widely expected by markets, the BoJ’s stance and communication continue to surprise us. Since November 2024, the central bank has developed a habit of not adhering to its "forward guidance" issued at the end of its meetings and instead signaling its decisions one week before the next meeting.

Substantively, the BoJ has been rather contradictory—showing increased confidence in economic and price prospects (as reflected in upward inflation revisions) while maintaining persistent caution regarding the "timing" and extent of further monetary normalization.

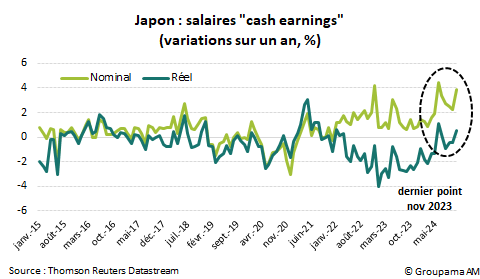

We continue to believe that the trajectory of wages and its impact on prices will remain the key determinant of the BoJ’s next move. The spring wage negotiations, with initial results expected from March, will therefore be crucial.

Regardless of the "timing," our monetary policy outlook remains unchanged: normalization will continue but cautiously, with two additional hikes expected and a terminal rate of 1% by the end of 2025. The recent resurgence of inflation and depreciation pressures on the yen could push authorities to act before summer. However, the arrival of new voting members on the Committee starting in April and the key elections scheduled for July 20 could shift the outlook.

DISCLAIMER

This document is intended exclusively for informational purposes.

Groupama Asset Management and its subsidiaries disclaim all liability in the event of any alteration, distortion, or falsification of this document. Any modification, unauthorized use, or distribution, in whole or in part, in any manner whatsoever, is prohibited.

Before making any investment, investors must review the prospectus or the Key Investor Information Document (KIID) of the fund. These documents, along with other periodic reports, can be obtained free of charge upon request from Groupama AM or via www.groupama-am.com.

This non-contractual document does not constitute, under any circumstances, a recommendation, a solicitation of an offer, or an offer to buy, sell, or trade securities, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized recommendations.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com