2/ Increasing military spending: how much and how?

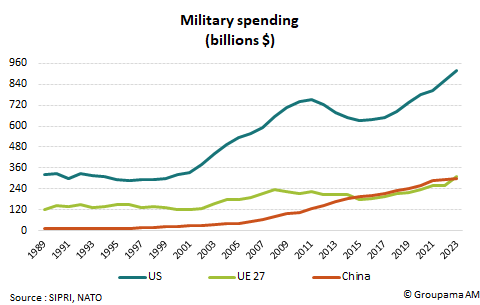

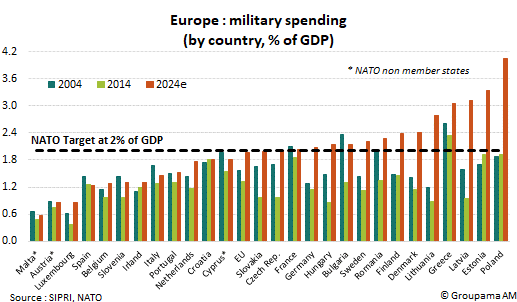

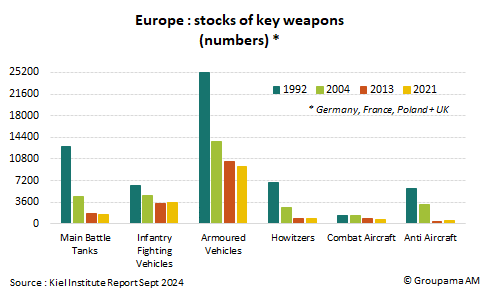

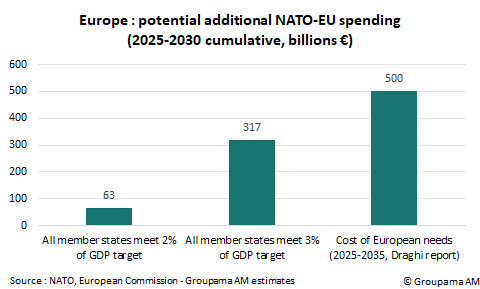

In this context, the investment needs are considerable. If all European NATO countries aim to meet the potentially raised target of 3% of GDP by 2030, the additional required spending is estimated at over €300 billion compared to 2024 levels (see Chart 5). According to the Draghi report (September 2024), additional defence investments could reach €500 billion over the next decade to replenish the stockpiles sent to help Ukraine. The number could be much higher if the United States continues to scale back its military commitment in the continent.

Several initiatives announced in recent days represent a historic start to address urgent sovereignty issues. At the European level, the "ReArm Europe" plan aims to give Member States more flexibility, allowing them to increase military spending without worsening their public deficits (€650 billion over 4 years). It also allows the European Commission to borrow on the markets and lend to Member States (€150 billion). This notably follows the decision of Germany’s incoming chancellor, Friedrich Merz, to increase military spending by €400 billion while also boosting infrastructure investment by €400–500 billion over a 10-year horizon.

3/ What are the impacts on growth?

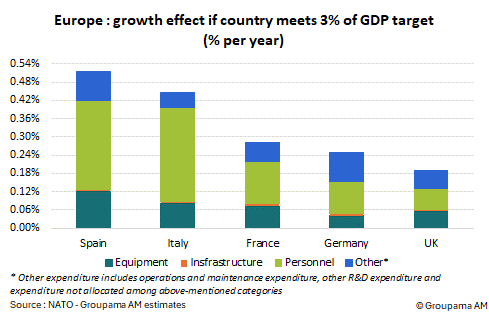

Such measures will have significant macroeconomic implications. We assume that those investment plans, if properly deployed, will allow Member States to raise their military spending to 3% of GDP. Our estimates suggest a positive impact of around 0.3% additional GDP growth per year in the eurozone. The multiplier effect is stronger in Spain and Italy (see Chart 6). These economies require more efforts, as their military spending relative to GDP remains below the 2% target, while Germany and France have already met the NATO goal. Furthermore, the share of spending allocated to military personnel is higher in these countries, suggesting stronger positive effects than those resulting from spending on equipment or infrastructure (1).

At the same time, higher military spending could trigger inflationary effects through a positive demand shock. This reflationary outlook would then reduce pressure on the ECB's policy rates (see email: "ECB: monetary policy is becoming significantly less restrictive").

(1) According to the literature, direct multiplier effects are higher for military personnel spending (around 1.2) than for spending on equipment, infrastructure, and other categories (0.9).