As expected, the Governing Council decided to lower its key interest rates by 25 basis points, reducing the deposit rate, the refinancing rate, and the marginal lending rate to 2.75%, 2.90%, and 3.15%, respectively. The ECB maintains its "data-dependent" approach, meeting by meeting, and does not commit in advance to a specific rate trajectory. The ECB remains in "risk management mode" and continues to closely monitor activity and price indicators. At this stage, the ECB considers that risks to growth remain tilted to the downside, while the disinflation process is on track.

Key takeaways:

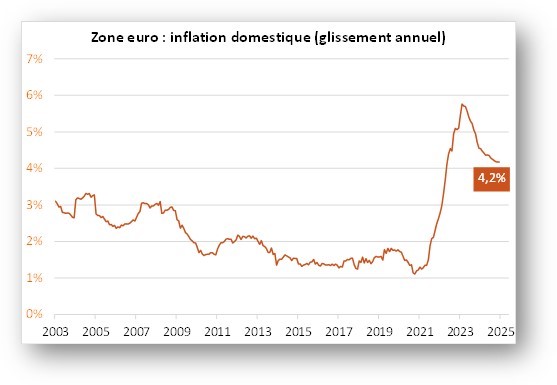

- The disinflation process was described as "on track": inflation data are "broadly in line" with the ECB's projections and therefore consistent with a return to the 2% target in the medium term; domestic inflation remains high (see Graph 1) due to ongoing wage adjustments, but recent data suggest that wage pressures are easing (this is a matter of timing).

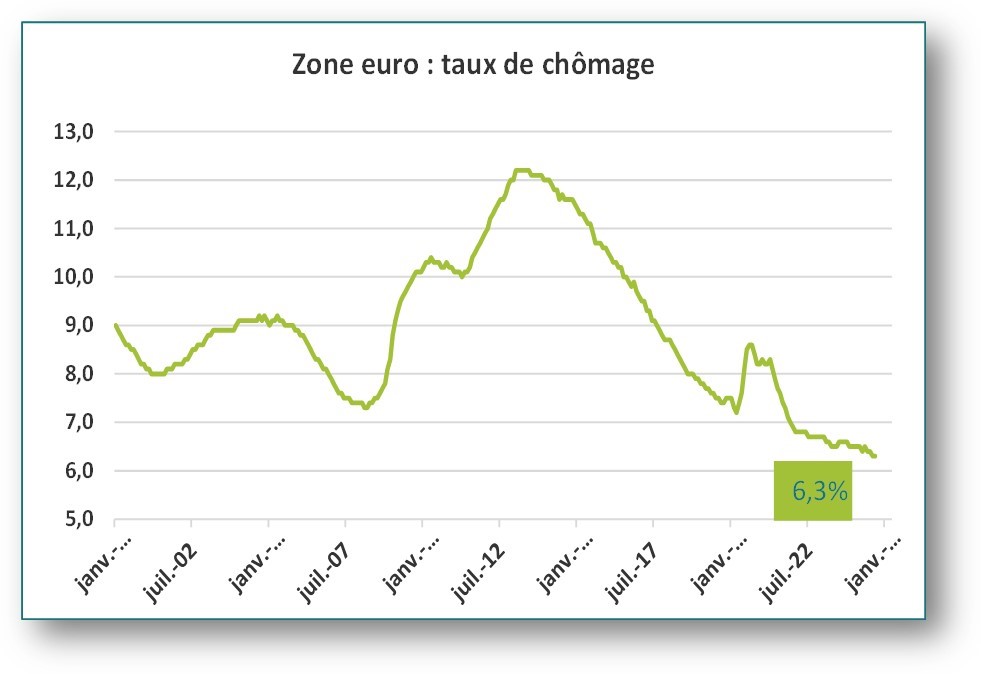

- The economy is expected to remain weak in the short term, but the conditions for a recovery remain in place: the labor market has cooled but remains robust, with the unemployment rate at a record low of 6.3% (see Graph 2); the strength of employment and income growth should support consumption, and exports should also support the recovery.

- The decision was easy to make as it was unanimous. There was no discussion of a 50 basis point cut. At 2.75%, the key rate is still considered "restrictive," and there was no discussion on the level of the neutral rate, which the President described as "premature." Christine Lagarde mentioned that new estimates of the neutral rate would be published on February 7, which could serve as a basis for discussion within the Governing Council.

Overall, the ECB President remains convinced that inflation will sustainably return to 2% and that the economy will remain weak in the short term. In these circumstances, and even though the ECB has not committed in advance to any specific rate trajectory, it is quite clear that it intends to continue lowering rates at its next meeting in March, in line with our scenario. From 2.5%, the key rate would likely be at the upper end of the range recently provided by Christine Lagarde for the neutral rate, which is between 1.75% and 2.5%. At this level, debates within the Council will very likely intensify.

DISCLAIMER

This document is intended exclusively for informational purposes.

Groupama Asset Management and its subsidiaries disclaim any responsibility for any alteration, distortion, or falsification this document may undergo. Any unauthorized modification, use, or distribution, in whole or in part, in any manner is prohibited.

Before making any investment, every investor must review the prospectus or the Key Investor Information Document (KIID) of the fund. These documents and other periodic documents can be obtained free of charge upon request from Groupama AM or on www.groupama-am.com.

This non-contractual document does not constitute a recommendation, an offer solicitation, or an offer to buy, sell, or exchange, and should in no way be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized recommendations.

Published by Groupama Asset Management – Headquarters: 25 rue de la Ville l’Evêque, 75008 Paris – Website: www.groupama-am.com