The main assumption of our economic scenario is that we are in a world of transitions (geopolitical, environmental, digital, and demographic). All these transitions are fueling a sustainable investment cycle, albeit with periods of "stop and go" (pause/acceleration). From this perspective, 2024 has been a pause phase in the investment cycle following the sharp rise in interest rates, which triggered a recession in global industry and the construction sector in most developed countries.

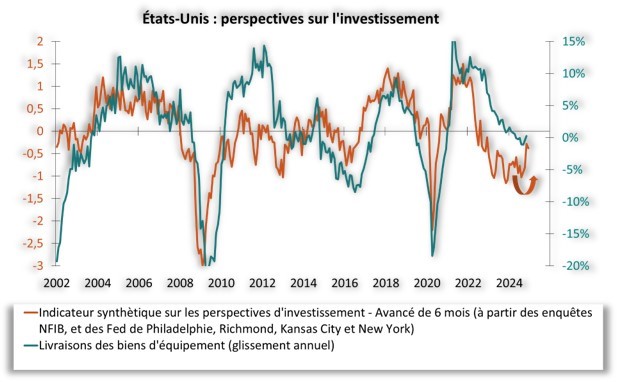

However, at the turn of the year, the "lights are green." Indeed, nearly all macroeconomic determinants support a gradual restart of investment in developed countries (see compass below): investment needs are massive, financing conditions are becoming favorable again, corporate profitability has generally been restored, companies have deleveraged, and finally, consumption is resilient enough for businesses to be reassured about their prospects. Already, our investment tracker in the United States shows signs of a "rebound" (Chart 1).

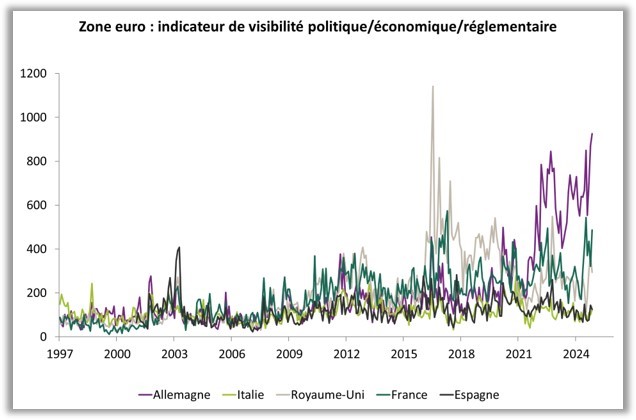

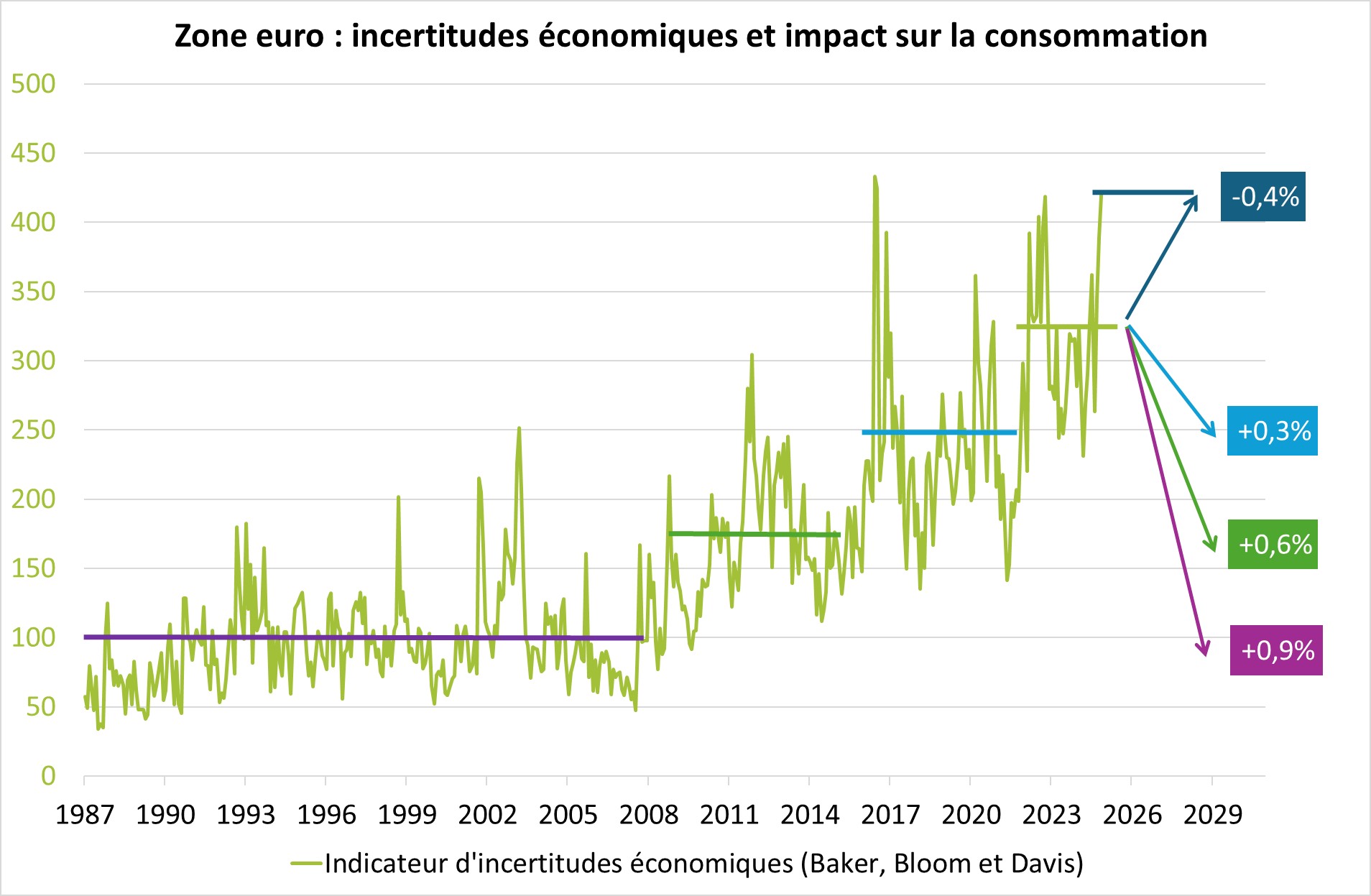

However, one factor may delay this investment recovery, namely the rise in uncertainties. In Europe, trade, geopolitical, and political uncertainties, as measured by the indices constructed by Baker, Bloom, and Davis (Economic Policy Uncertainty Index), have been rising sharply in France, and especially in Germany (Chart 2).

Source : Bloomberg – Calculs : Groupama AM

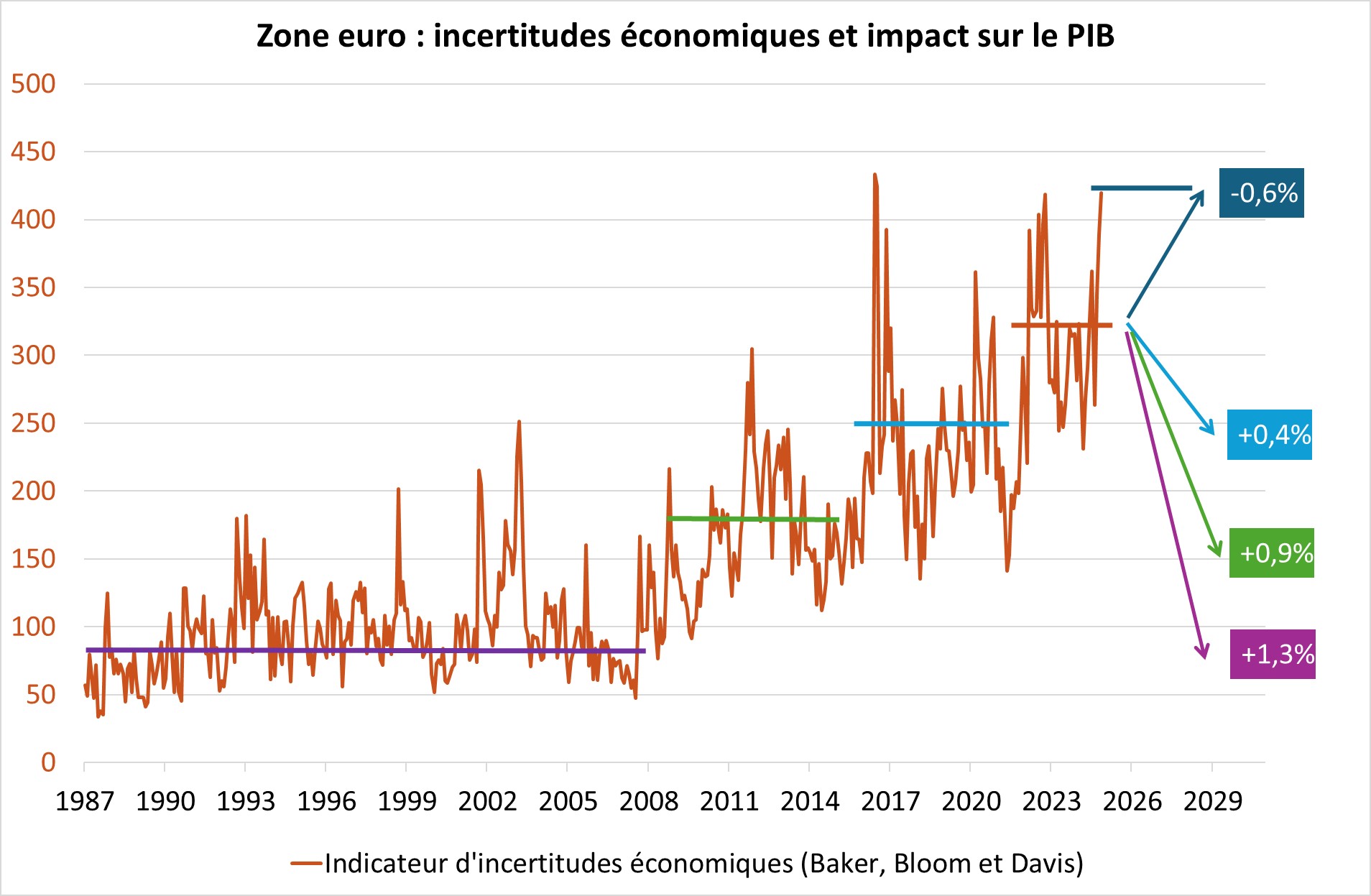

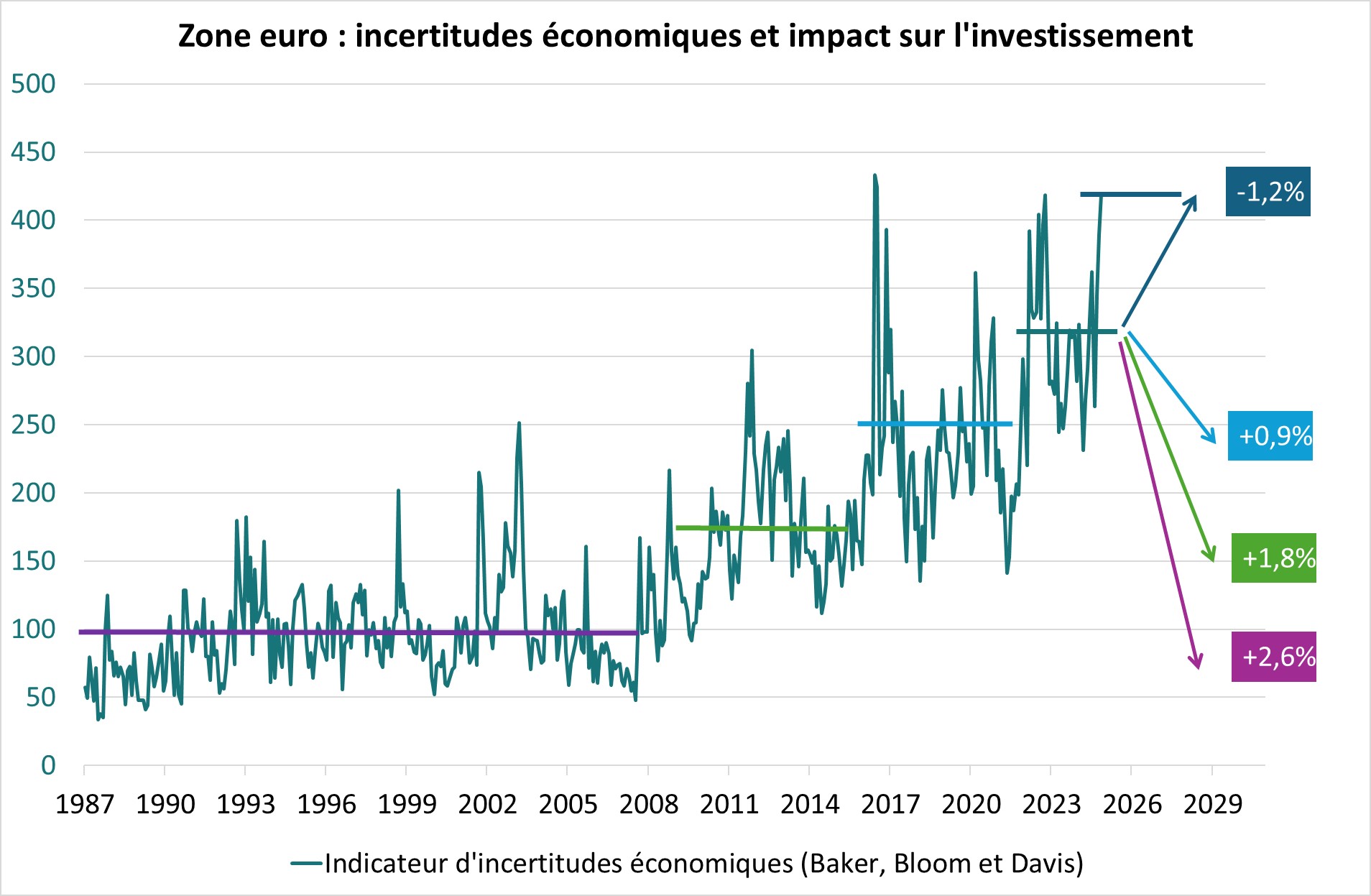

Therefore, we sought to assess the impact of these uncertainties on GDP growth, investment, and consumption, by replicating the methodology from a working paper by the European Commission (The cost of uncertainty – new estimates - European Commission (europa.eu)). We reached the following conclusions:

- Uncertainties have an impact three times greater on investment than on consumption.

- If the recent tension on uncertainties persists, indicating a new upward regime shift, it could reduce Eurozone GDP growth by half a percentage point over the year, with an adjustment of more than 1% on investment (Charts 3 & 4).

- However, positive risks should not be dismissed. For instance, a decrease in uncertainties, returning to the pre-Covid regime (the turquoise bar in the charts below), would support GDP growth by +0.4% over the year, via a +0.9% increase in investment and +0.3% in consumption. A return to the regime prevailing in the 2010-2015 period (light green bar) would have twice the impact on economic activity (+0.9% on GDP).

In conclusion, if the recent rise in uncertainties is confirmed, it is likely to weigh on our investment and growth projections for the Eurozone, particularly in Germany and France. However, the "balance of risks" is not symmetric: when uncertainties are already high, it is more likely they will decrease rather than rise. The recovery of investment may be delayed in the short term, but it is not in question in the medium term.

Source : Bloomberg – Calculs : Groupama AM

Methodology: A VAR model applied to 4 variables (economic uncertainty indicator, interest rates, oil prices, euro-dollar exchange rate), along with an economic aggregate (GDP, investment, or consumption growth) and two dummy variables (corresponding to the peaks of the 2009 financial crisis and the Covid crisis). All variables are observed on a quarterly change basis, over the period from 1995 to 2024. We incorporate lags of order 4. The impact calculations are obtained from a "shock" (positive or negative) on economic uncertainty and the "response functions" on the aggregates of GDP growth, investment, and consumption.