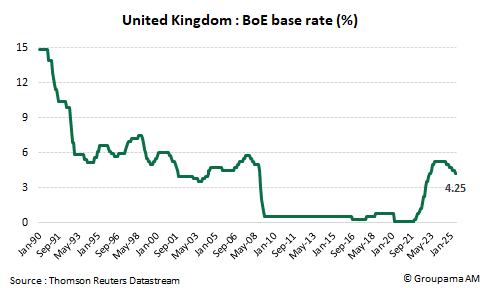

The Bank of England (BoE) maintained its key interest rate at 4.25% following its June 19, 2025 meeting (see Chart 1). Forward guidance remains unchanged: the institution will continue its “gradual and cautious” approach, and monetary policy must remain “sufficiently restrictive for sufficiently long” to bring inflation sustainably back to the 2% target over the medium term.

With no quarterly Monetary Policy Report or press conference, the BoE offered few new insights. However, the Monetary Policy Committee (MPC) appeared more “dovish” than at the May meeting. Notably:

- The vote shifted slightly, with Dave Ramsden joining Alan Taylor and Swati Dhingra in favor of a 25 basis point cut. Six members preferred to keep the rate at 4.25% (compared to seven in May).

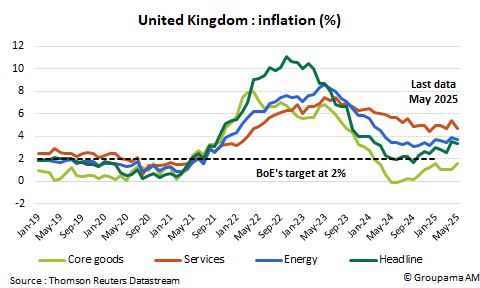

- The MPC does not appear overly concerned about recent inflation trends. While the Consumer Price Index rose 3.4% year-on-year in May—well above the 2% target (see Chart 2)—this increase was anticipated (linked to regulated prices and previous energy price hikes) and aligned with projections from the May Monetary Policy Report. Forecasts for the second half of the year remain unchanged: inflation is expected to stay around current levels before gradually returning to target next year. The inflation risk balance is considered neutral. Although not decisive in the June decision, rising tensions in the Middle East will be monitored. On the other hand, disinflationary pressures are more pronounced in the labor market.

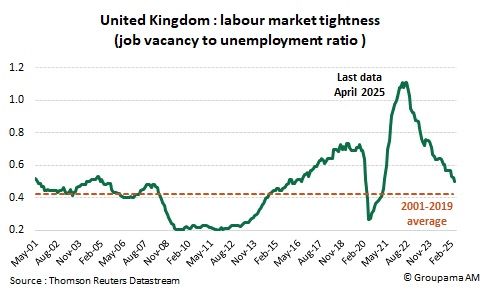

- Signs of economic weakness are becoming more evident. The BoE described underlying GDP growth as weak, with surveys suggesting near-zero momentum. It also highlighted a more pronounced labor market slowdown, including a drop in job vacancies, a sharp decline in the vacancy-to-unemployment ratio (see Chart 3), falling payroll employment, and continued wage moderation in line with forecasts. Additionally, the Committee cited geopolitical conflicts as new risks to the economy.

Thus, the status quo reinforces common trends seen across most developed economies: central banks are currently in a wait-and-see mode amid high uncertainty. However, in the UK, interest rates may remain “on a gradual downward path” (Governor Bailey). Weaker economic data, particularly the easing of labor market tensions and the faster-than-expected slowdown in wages, allow policymakers to soon continue the easing of monetary policy. As a result, we are bringing forward the timeline toward neutrality, now projecting two additional rate cuts this year: -25 basis points per meeting in August and November, with a terminal rate of 3.75% by the end of 2025.

DISCLAIMER

This document is intended exclusively for informational purposes.

Groupama Asset Management and its subsidiaries disclaim all liability in the event of any alteration, distortion, or falsification of this document. Any unauthorized modification, use, or distribution, in whole or in part, in any form whatsoever, is prohibited.

Before making any investment, investors must read the prospectus or the Key Investor Document (KID) of the fund. These documents and other periodic reports are available free of charge upon request from Groupama AM or at www.groupama-am.com.

This non-contractual material does not constitute, under any circumstances, a recommendation, a solicitation of an offer, or an offer to buy, sell, or arbitrate, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized investment advice.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com