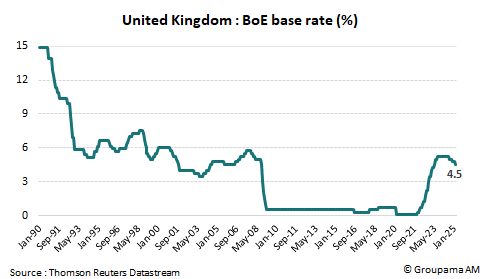

At the conclusion of its meeting on February 6, 2025, the Bank of England (BoE) continued the normalization of its monetary policy by lowering its main interest rate by 25 basis points (bps). The rate now stands at 4.5% (see chart 1). This is the third reduction since August 2024. The "forward guidance" remains unchanged: monetary policy must be "sufficiently restrictive for a sufficiently long period to bring inflation back to the 2% target in a sustainable manner over the medium term."

The decision was not a surprise. However, the official statements describe a central bank that appears somewhat contradictory:

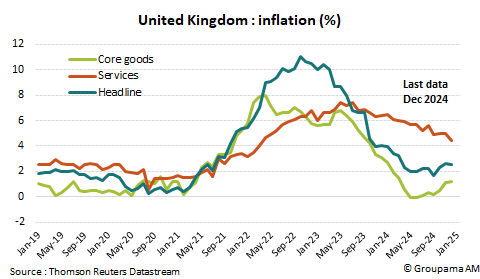

On one hand, it seems to be taking a more accommodative turn. For the first time, all members of the Committee voted in favor of a rate cut, with Swati Dhingra and Catherine Mann (the most "hawkish" member) even opting for a 50bps cut. On the substance, the BoE is pleased with the progress made in terms of inflation and wage trajectories. These are considered "sufficient" to allow the main interest rate to be reduced to 4.5%. As a reminder, in December, inflation was at 2.5% (see chart 2). The decision to lower interest rates is even more justified given the worsening economic context, so that growth forecasts are lower than those presented in the November 2024 quarterly report (0.75% in 2025 versus 1.5% projected in November).

However, this apparent more accommodative tilt is tempered by stricter inflation forecasts and more cautious rhetoric regarding the medium term. For the BoE, although domestic inflationary pressures are moderating, they remain "somewhat high, and some indicators have slowed more slowly than expected." The rise in global energy costs and adjustments to regulated prices "are expected to push inflation to 3.7% in Q3 2025" despite the deceleration in underlying inflation. Therefore, inflation will not fall below the 2% target before 2028. While the BoE still has room to reduce rates, it must adopt a "gradual and cautious" approach, "meeting by meeting." Until December, the BoE had only mentioned a "gradual" strategy. The word "cautious" ("careful") was added this month to account for uncertainties regarding the global environment, which make "the path to disinflation more bumpy."

It emerges from the meeting that the BoE remains vigilant regarding persistent inflationary pressures. We believe that the institution still has an "opportunity window" for a further 25bps cut to 4.25% at the upcoming meeting on May 8, before taking a pause to assess the impact of the increase in airfares and VAT on private school tuition fees (January) and the increase in the minimum wage (April).

At 4.25%, monetary policy remains restrictive. Additional rate cuts should occur to return to neutrality. The BoE has revised its neutral rate upwards, noting that analyst models place the new interest rate between 25 and 75bps higher than the 2%-3% range estimated in February 2018. This means the current neutral rate would be between 2.25% and 3.75%. Our estimates suggest a neutral rate between 3%-3.25%. We thus maintain our forecast of 2 additional rate cuts in 2026 (-25bps per meeting) to bring the main interest rate to 3.75%.