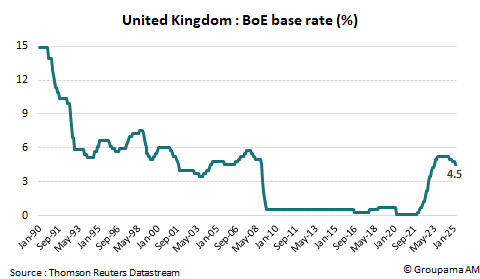

The Bank of England (BoE) maintained its key interest rate at 4.5% following its March 20, 2025 meeting (see Chart 1). Forward guidance remains unchanged: the institution will continue its "gradual and careful" approach, and monetary policy “will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further”.

With no Monetary Policy Report or press conference, the BoE provided few new insights. However, we highlight two key points:

• A Slightly More Hawkish Tone

In terms of the vote, the status quo was supported by 8 members against 1. Catherine Mann, who had surprised markets in February by suddenly advocating for a 50 basis-point (bp) rate cut, switched sides again and voted to hold. Only Swati Dhingra continued to support further monetary easing, this time calling for a 25bp cut, instead of 50bp like in February.

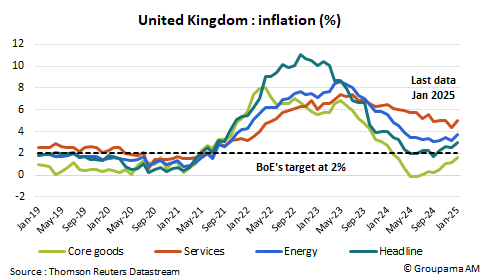

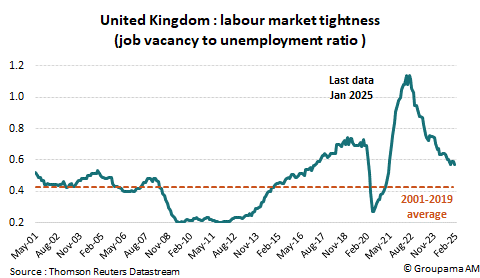

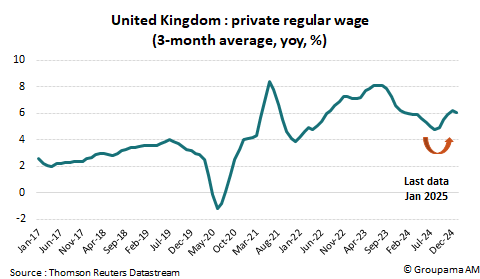

Substantively, the majority of members once again expressed concern about the recent acceleration in headline inflation since the Committee’s last meeting in February. In January, inflation reached 3%, exceeding the central bank’s forecast, after having fallen to 1.7% in September 2024. The renewed increase has been broad-based, particularly driven by services inflation, which has returned to levels last seen in autumn 2024 (see Chart 2). Meanwhile, labour market indicators continue to show signs of tightness. The job vacancy to unemployment ratio has remained steady, despite surveys suggesting a decline in hiring intentions ahead of the increase in employer payroll taxes scheduled for April (see Chart 3). As a result, wage growth remains strong, especially in the private sector, where it's hovering around 6% (see Chart 4).

• Limited Visibility on Future Decisions

Despite clear concerns about short- and medium-term inflation risks, the BoE’s official statements remain vague, refusing to signal any “pre-set path over the next few meetings”. On the one hand, the Bank reiterated its "gradual and careful" approach and noted that it would need more evidence to assess the underlying disinflationary process. On the other hand, it acknowledged that global (trade and geopolitical) uncertainties have intensified, and that a “greater or longer-lasting weakness in demand relative to supply” could “push down on inflationary pressures, warranting a less restrictive path of Bank Rate”.

As such, the BoE’s decision aligns with that of other central banks (e.g., the Fed or the Bank of Japan). With high uncertainty, the priority is to hold course and avoid hasty changes. This reinforces our scenario of limited monetary easing: we expect one additional 25bp cut in 2025 and two more cuts in 2026 (-25bp per meeting), which would bring Bank Rate to 3.75%, i.e., the upper bound of the estimated neutral rate range (2.25%–3.75%). We believe the BoE still has a window of opportunity to lower its rate at the May 8 meeting. By then, it will have more information: both geopolitical and trade-related (including announcements from Washington starting April 2), and economic data (including two inflation and wage reports).

DISCLAIMER

This document is intended for informational purposes only.

Groupama Asset Management and its subsidiaries disclaim any liability in the event of alteration, distortion, or falsification of this document. Any unauthorized modification, use, or distribution, in whole or in part, in any form whatsoever is prohibited.

Before making any investment, investors must review the prospectus or the Key Investor Information Document (KIID) of the UCITS. These documents, along with other periodic reports, are available free of charge upon request from Groupama AM or at www.groupama-am.com.

This non-contractual document does not constitute a recommendation, a solicitation, or an offer to buy, sell, or trade, and should not be interpreted as such.

The sales teams of Groupama Asset Management and its subsidiaries are available to provide you with personalized recommendations.

Published by Groupama Asset Management – Registered office: 25 rue de la Ville l’Évêque, 75008 Paris – Website: www.groupama-am.com